Page 18 - The Summit of the Americas 2021

P. 18

INSIDER

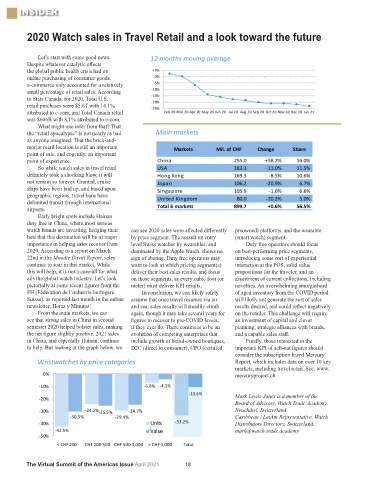

2020 Watch sales in Travel Retail and a look toward the future

Let’s start with some good news.

Despite whatever catalytic effects

the global public health crisis had on

online purchasing of consumer goods,

e-commerce only accounted for a relatively

small percentage of retail sales. According

to Stats Canada, for 2020, Total U.S.

retail purchases were $5.6T with 14.1%

attributed to e-com, and Total Canada retail

was $606B with 8.1% attributed to e-com.

What might one infer from that? That

the “retail apocalypse” is not nearly as bad

as anyone imagined. That the brick-and-

mortar retail location is still an important

point of sale, and cogently, an important

point of experience.

So while watch sales in travel retail

definitely took a shocking blow, it will

not remain so forever. Granted, cruise

ships have been laid up, and based upon

geographic regions, travel bans have

delimited transit through international

airports.

Early bright spots include Hainan

duty free in China, where most serious

watch brands are investing, hedging their can see 2020 sales were affected differently preowned) platforms, and the wearable

bets that this destination will be of major by price segment. The assault on entry (smart watch) segment.

importance in helping sales recover from level Swiss watches by wearables, and Duty free operators should focus

2020. According to a report on March dominated by the Apple Watch, shows no on best-performing price segments,

22nd in the Moodie Davitt Report, sales sign of abating. Duty free operators may introducing some sort of experiential

continue to soar in this market. While want to look at which pricing segment(s) interaction at the POS, solid value

this will help, it is not a cure-all for what deliver their best sales results, and focus propositions for the traveler, and an

ails the global watch industry. Let’s look on those segments, as every cubic foot (or assortment of current collections, including

pictorially at some recent figures from the meter) must deliver KPI results. novelties. An overwhelming smorgasbord

FH (Fédération de l’industrie horlogère In conclusion, we can likely safely of aged inventory from the COVID period

Suisse), as reported last month in the online assume that once travel resumes via air will likely not generate the sort of sales

newsletter, Horas y Minutos: and sea, sales results will steadily climb results desired, and could reflect negatively

From the main markets, we can again, though it may take several years for on the retailer. This challenge will require

see that strong sales in China in second figures to recover to pre-COVID levels, an investment of capital and clever

semester 2020 helped bolster sales, making if they ever do. There continues to be an planning, strategic alliances with brands,

the net figure slightly positive. 2021 sales evolution of competing enterprises that and a capable sales staff.

in China, and especially Hainan, continue include growth of brand-owned boutiques, Finally, those interested in the

to help. But looking at the graph below, we D2C (direct to consumer), CPO (certified important KPI of sell-out figures should

consider the subscription based Mercury

Report, which includes data on over 10 key

markets, including travel retail. See: www.

mercuryproject.ch

Mark Lewis-Jones is a member of the

Board of Advisors, Watch Trade Academy,

Neuchâtel, Switzerland

Caribbean / LatAm Representative, Watch

Distributors Directory, Switzerland.

mark@watch-trade.academy

The Virtual Summit of the Americas Issue April 2021 18