Page 25 - Insurance Times July 2022

P. 25

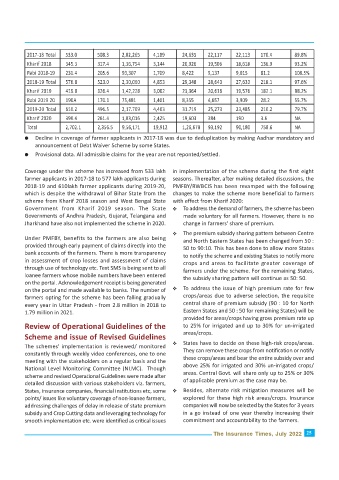

Decline in coverage of farmer applicants in 2017-18 was due to deduplication by making Aadhar mandatory and

announcement of Debt Waiver Scheme by some States.

Provisional data. All admissible claims for the year are not reponted/settled.

Coverage under the scheme has increased from 533 lakh in implementation of the scheme during the first eight

farmer applicants in 2017-18 to 577 lakh applicants during seasons. Thereafter, after making detailed discussions, the

2018-19 and 610lakh farmer applicants during 2019-20, PMFBY/RWBCIS has been revamped with the following

which is despite the withdrawal of Bihar State from the changes to make the scheme more beneficial to farmers

scheme from Kharif 2018 season and West Bengal State with effect from Kharif 2020:

Government from Kharif 2019 season. The State To address the demand of farmers, the scheme has been

Governments of Andhra Pradesh, Gujarat, Telangana and made voluntary for all farmers. However, there is no

Jharkhand have also not implemented the scheme in 2020. change in farmers' share of premium.

The premium subsidy sharing pattern between Centre

Under PMFBY, benefits to the farmers are also being

and North Eastern States has been changed from 50 :

provided through early payment of claims directly into the

50 to 90:10. This has been done to allow more States

bank accounts of the farmers. There is more transparency

to notify the scheme and existing States to notify more

in assessment of crop losses and assessment of claims

crops and areas to facilitate greater coverage of

through use of technology etc. Text SMS is being sent to all

farmers under the scheme. For the remaining States,

loanee farmers whose mobile numbers have been entered

the subsidy sharing pattern will continue as 50: 50.

on the portal. Acknowledgement receipt is being generated

To address the issue of high premium rate for few

on the portal and made available to banks. The number of

crops/areas due to adverse selection, the requisite

farmers opting for the scheme has been falling gradually

central share of premium subsidy (90 : 10 for North

every year in Uttar Pradesh - from 2.8 million in 2018 to

Eastern States and 50 : 50 for remaining States) will be

1.79 million in 2021.

provided for areas/crops having gross premium rate up

Review of Operational Guidelines of the to 25% for irrigated and up to 30% for un-irrigated

areas/crops.

Scheme and issue of Revised Guidelines

States have to decide on these high-risk crops/areas.

The schemes' implementation is reviewed/ monitored

They can remove these crops from notification or notify

constantly through weekly video conferences, one to one

these crops/areas and bear the entire subsidy over and

meeting with the stakeholders on a regular basis and the

above 25% for irrigated and 30% un-irrigated crops/

National Level Monitoring Committee (NLMC). Though

areas. Central Govt. will share only up to 25% or 30%

scheme and revised Operational Guidelines were made after

of applicable premium as the case may be.

detailed discussion with various stakeholders viz. farmers,

States, insurance companies, financial institutions etc, some Besides, alternate risk mitigation measures will be

points/ issues like voluntary coverage of non-loanee farmers, explored for these high risk areas/crops. Insurance

addressing challenges of delay in release of state premium companies will now be selected by the States for 3 years

subsidy and Crop Cutting data and leveraging technology for in a go instead of one year thereby increasing their

smooth implementation etc. were identified as critical issues commitment and accountability to the farmers.

The Insurance Times, July 2022 25