Page 35 - Insurance Times October 2020

P. 35

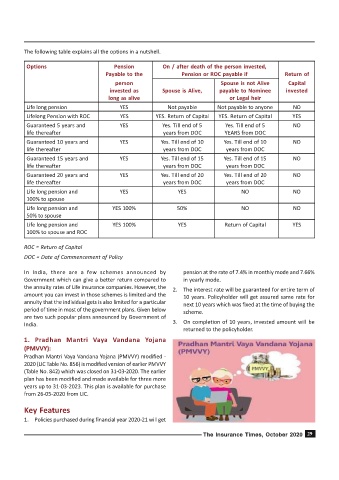

The following table explains all the options in a nutshell.

Options Pension On / after death of the person invested,

Payable to the Pension or ROC payable if Return of

person Spouse is not Alive Capital

invested as Spouse is Alive, payable to Nominee invested

long as alive or Legal heir

Life long pension YES Not payable Not payable to anyone NO

Lifelong Pension with ROC YES YES. Return of Capital YES. Return of Capital YES

Guaranteed 5 years and YES Yes. Till end of 5 Yes. Till end of 5 NO

life thereafter years from DOC YEARS from DOC

Guaranteed 10 years and YES Yes. Till end of 10 Yes. Till end of 10 NO

life thereafter years from DOC years from DOC

Guaranteed 15 years and YES Yes. Till end of 15 Yes. Till end of 15 NO

life thereafter years from DOC years from DOC

Guaranteed 20 years and YES Yes. Till end of 20 Yes. Till end of 20 NO

life thereafter years from DOC years from DOC

Life long pension and YES YES NO NO

100% to spouse

Life long pension and YES 100% 50% NO NO

50% to spouse

Life long pension and YES 100% YES Return of Capital YES

100% to spouse and ROC

ROC = Return of Capital

DOC = Date of Commencement of Policy

In India, there are a few schemes announced by pension at the rate of 7.4% in monthly mode and 7.66%

Government which can give a better return compared to in yearly mode.

the annuity rates of Life insurance companies. However, the 2. The interest rate will be guaranteed for entire term of

amount you can invest in those schemes is limited and the 10 years. Policyholder will get assured same rate for

annuity that the individual gets is also limited for a particular next 10 years which was fixed at the time of buying the

period of time in most of the government plans. Given below scheme.

are two such popular plans announced by Government of

India. 3. On completion of 10 years, invested amount will be

returned to the policyholder.

1. Pradhan Mantri Vaya Vandana Yojana

(PMVVY):

Pradhan Mantri Vaya Vandana Yojana (PMVVY) modified -

2020 (LIC Table No. 856) is modified version of earlier PMVVY

(Table No. 842) which was closed on 31-03-2020. The earlier

plan has been modified and made available for three more

years up to 31-03-2023. This plan is available for purchase

from 26-05-2020 from LIC.

Key Features

1. Policies purchased during financial year 2020-21 will get

The Insurance Times, October 2020