Page 36 - Insurance Times October 2020

P. 36

4. In case of death of the policyholder before completion Increase in Seniors:

of 10 years term, invested amount will be returned to

nominee of the policyholder.

5. Interest rate for policies purchased beyond 2020-21 will

be revised by Ministry of Finance on the beginning of

each financial year.

2. Senior Citizens Savings Scheme (SCSS)

This scheme is also available to the people above 60 years

of age. The amount deposited will have a fixed rate of

interest for 5 years and can be renewed for another 3 years.

However, the interest rate will be as per the prevailing rates

at that time. The SCSS rate of interest for April to June 2020

has been set at 7.4%. Maximum amount that one can Those who are in their 30s now will reach their 60s by 2050

invest is Rs.15 Lakhs only. and they live longer than those who are in their 60s now.

Hence, if they want to live peacefully even after their

However, the amounts received under this scheme are retirement at the age of 50 or 60, they need to plan for a

taxable like annuity. regular income now. For such people deferred annuity plans

are suitable. They can invest for about 20 years or more and

Need for Pension: they can get a regular income on the basis of accumulated

corpus and prevailing annuity rates at that time.

Regular Income : Any person would like to have a regular

income as long as he is alive. Planning for the same can During 1881, the average life expectancy of Indians was

make the person live a comfortable life all through. 25.44 years!! In 2019, as per our world in data website, it

Otherwise, at a particular age, income stops as the person is 69.56 years. If someone is planning for retirement goal

may not be able to work or carry on with his business due and his age is 30 years at present, and planning to retire at

to both external and personal family reasons. At that time 50 years of age, then the life expectancy with 0.5% inflation

also, he will need a regular income to maintain his basic would be 83 years when this guy turn 50 years of age.

needs. Whether you planned your retirement planning with 80

years or 90 years of life expectancy?

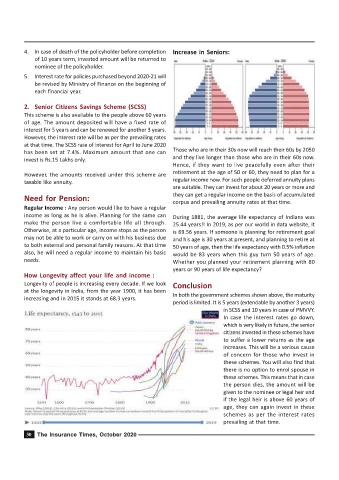

How Longevity affect your life and income :

Longevity of people is increasing every decade. If we look Conclusion

at the longevity in India, from the year 1900, it has been

increasing and in 2015 it stands at 68.3 years. In both the government schemes shown above, the maturity

period is limited. It is 5 years (extendable by another 3 years)

in SCSS and 10 years in case of PMVVY.

In case the interest rates go down,

which is very likely in future, the senior

citizens invested in these schemes have

to suffer a lower returns as the age

increases. This will be a serious cause

of concern for those who invest in

these schemes. You will also find that

there is no option to enrol spouse in

these schemes. This means that in case

the person dies, the amount will be

given to the nominee or legal heir and

if the legal heir is above 60 years of

age, they can again invest in these

schemes as per the interest rates

prevailing at that time.

The Insurance Times, October 2020