Page 38 - Banking Finance June 2021

P. 38

ARTICLE

2. Simplifies the negotiations involved in different languages, follow different trade practices, adopt

International Commerce: divergent business customs. In 1980, the United Nations

Convention on Contracts for the International Sale of Goods

Buyers across the world want to know the "landed cost" of

("CISG") announced a set of principles which serves as a legal

the goods they wish to buy which is the final price inclusive

of shipping and taxes before they finalize the contract. But framework to international contracts for the sale of goods.

The Incoterms® are in synchronization with the CISG.

the seller may not be able to provide the same as tariffs

Incoterms are generally letters of abbreviations that are

and taxes vary widely throughout the world. But the usage

global and have a universal meaning as to the responsibility

of INCOTERMS® makes it easier to calculate the final cost

of the goods and promotes transparent delivery system. of the parties, terms of sale, point of origin and destination.

When parties decide on a given INCOTERM, they are

implicitly agreeing to a set of obligations; these obligations

3. Ensures common understanding of

are not to be referred to again in the sales contract. Since

Obligations: Incoterms® are not law themselves, they must be written

Incoterms® help in avoiding the confusion created by various into a sales contract in order to be bound to a contract.

interpretations of the rules followed in different countries.

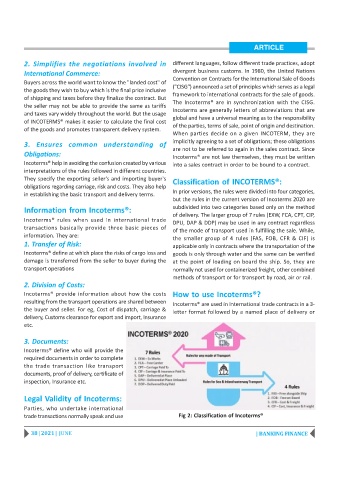

They specify the exporting seller's and importing buyer's Classification of INCOTERMS®:

obligations regarding carriage, risk and costs. They also help

in establishing the basic transport and delivery terms. In prior versions, the rules were divided into four categories,

but the rules in the current version of Incoterms 2020 are

Information from Incoterms®: subdivided into two categories based only on the method

of delivery. The larger group of 7 rules (EXW, FCA, CPT, CIP,

Incoterms® rules when used in international trade

DPU, DAP & DDP) may be used in any contract regardless

transactions basically provide three basic pieces of

of the mode of transport used in fulfilling the sale. While,

information. They are:

the smaller group of 4 rules (FAS, FOB, CFR & CIF) is

1. Transfer of Risk: applicable only in contracts where the transportation of the

Incoterms® define at which place the risks of cargo loss and goods is only through water and the same can be verified

damage is transferred from the seller to buyer during the at the point of loading on board the ship. So, they are

transport operations normally not used for containerized freight, other combined

methods of transport or for transport by road, air or rail.

2. Division of Costs:

Incoterms® provide information about how the costs How to use Incoterms®?

resulting from the transport operations are shared between

Incoterms® are used in International trade contracts in a 3-

the buyer and seller. For eg, Cost of dispatch, carriage & letter format followed by a named place of delivery or

delivery, Customs clearance for export and import, Insurance

etc.

3. Documents:

Incoterms® define who will provide the

required documents in order to complete

the trade transaction like transport

documents, proof of delivery, certificate of

inspection, Insurance etc.

Legal Validity of Incoterms:

Parties, who undertake international

trade transactions normally speak and use Fig 2: Classification of Incoterms®

38 | 2021 | JUNE | BANKING FINANCE