Page 30 - Banking Finance May 2020

P. 30

ARTICLE

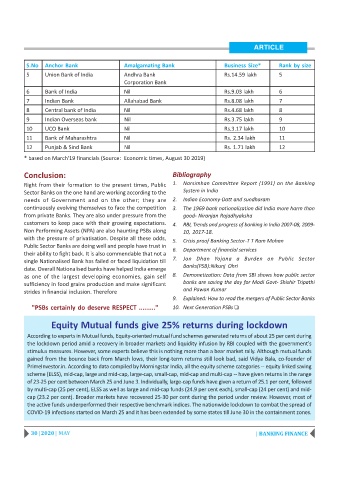

S.No Anchor Bank Amalgamating Bank Business Size* Rank by size

5 Union Bank of India Andhra Bank Rs.14.59 lakh 5

Corporation Bank

6 Bank of India Nil Rs.9.03 lakh 6

7 Indian Bank Allahabad Bank Rs.8.08 lakh 7

8 Central bank of India Nil Rs.4.68 lakh 8

9 Indian Overseas bank Nil Rs.3.75 lakh 9

10 UCO Bank Nil Rs.3.17 lakh 10

11 Bank of Maharashtra Nil Rs. 2.34 lakh 11

12 Punjab & Sind Bank Nil Rs. 1.71 lakh 12

* based on March'19 financials (Source: Economic times, August 30 2019)

Conclusion: Bibliography

Right from their formation to the present times, Public 1. Narsimhan Committee Report (1991) on the Banking

Sector Banks on the one hand are working according to the System in India

needs of Government and on the other; they are 2. Indian Economy-Datt and sundharam

continuously evolving themselves to face the competition 3. The 1969 bank nationalization did India more harm than

from private Banks. They are also under pressure from the good- Niranjan Rajadhyaksha

customers to keep pace with their growing expectations. 4. RBI, Trends and progress of banking in India 2007-08, 2009-

Non Performing Assets (NPA) are also haunting PSBs along 10, 2017-18.

with the pressure of privatisation. Despite all these odds,

5. Crisis proof Banking Sector-T T Ram Mohan

Public Sector Banks are doing well and people have trust in

6. Department of financial services

their ability to fight back. It is also commendable that not a

7. Jan Dhan Yojana a Burden on Public Sector

single Nationalised Bank has failed or faced liquidation till

Banks(PSB):Nikunj Ohri

date. Overall Nationalised banks have helped India emerge

as one of the largest developing economies, gain self 8. Demonetization: Data from SBI shows how public sector

sufficiency in food grains production and make significant banks are saving the day for Modi Govt- Shishir Tripathi

strides in financial inclusion. Therefore and Pawan Kumar

9. Explained: How to read the mergers of Public Sector Banks

"PSBs certainly do deserve RESPECT ........." 10. Next Generation PSBs

Equity Mutual funds give 25% returns during lockdown

According to experts in Mutual funds, Equity-oriented mutual fund schemes generated returns of about 25 per cent during

the lockdown period amid a recovery in broader markets and liquidity infusion by RBI coupled with the government's

stimulus measures. However, some experts believe this is nothing more than a bear market rally. Although mutual funds

gained from the bounce back from March lows, their long-term returns still look bad, said Vidya Bala, co-founder of

PrimeInvestor.in. According to data compiled by Morningstar India, all the equity scheme categories -- equity linked saving

scheme (ELSS), mid-cap, large and mid-cap, large-cap, small-cap, mid-cap and multi-cap -- have given returns in the range

of 23-25 per cent between March 25 and June 3. Individually, large-cap funds have given a return of 25.1 per cent, followed

by multi-cap (25 per cent), ELSS as well as large and mid-cap funds (24.9 per cent each), small-cap (24 per cent) and mid-

cap (23.2 per cent). Broader markets have recovered 25-30 per cent during the period under review. However, most of

the active funds underperformed their respective benchmark indices. The nationwide lockdown to combat the spread of

COVID-19 infections started on March 25 and it has been extended by some states till June 30 in the containment zones.

30 | 2020 | MAY | BANKING FINANCE