Page 724 - Insurance Statistics 2021

P. 724

Indian Non-life Insurance Industry

Yearbook 2018-19

Chart 3.3.3 Growth in GDPI split by Distribution Channel

50000.00

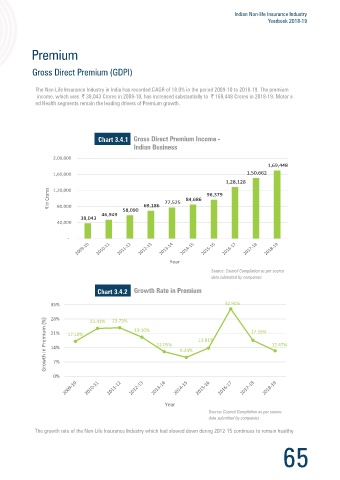

The Non-Life Insurance Industry in India has recorded CAGR of 18.0% in the period 2009-10 to 2018-19. The premium

income, which was 38,043 Crores in 2009-10, has increased substantially to 169,448 Crores in 2018-19. Motor a

nd Health segments remain the leading drivers of Premium growth.

40000.00

GDPI (₹ in Crores) 30000.00 44,538 41,469 47,299 41,278 45,545 14,764 Chart 3.4.1

20000.00

9,018 8,444 33,440 12,259 11,294 2,00,000 1,69,448

10000.00 7,526 1,60,000 1,50,662

1,433 1,707 1,28,128

5 57 15 20 1,20,000 96,379

0.00 ₹ in Crores 77,525 84,686

Year 80,000 58,090 69,186

46,949

38,043

40,000

Individual Agents Corporate Agents-Bank Corporate Agents- Others

Brokers Referral Arrangement Direct Business- Internet

-

Direct Business- Other than internet Micro Insurance Agent Others

Source: Council Compilation as per source

Year

data submitted by companies

Source: Council Compilation as per source

data submitted by companies

For the year 2018-19, share of premium sourced through direct channels has decreased slightly to 36.6 %. The share of

premium via Individual Agents has decreased marginally to 27.9%. Offsetting these reductions, Corporate Agency share Chart 3.4.2

has increased to about 11.0% and share of premium via Brokers has increased marginally to 24.4%.

35% 23.41% 23.73% 32.94%

Growth in Premium (%) 21% 17.10% 19.10% 12.05% 9.24% 13.81% 17.59% 12.47%

28%

14%

7%

0%

Year

Source: Council Compilation as per source

data submitted by companies

The growth rate of the Non-Life Insurance Industry which had slowed down during 2012-15 continues to remain healthy

64 65