Page 760 - Insurance Statistics 2021

P. 760

Indian Non-life Insurance Industry

Yearbook 2018-19

The Net Incurred Claims ratio has been brought down, arriving at 89.10% in 2018-19.

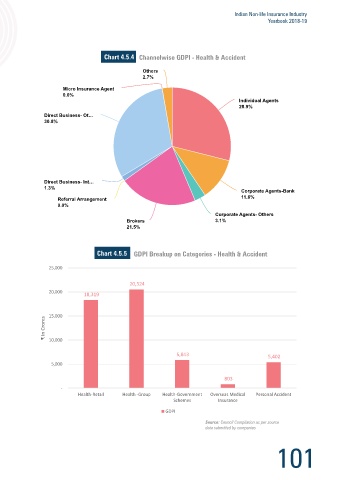

Chart 4.5.4 Channelwise GDPI - Health & Accident

Net Incurred Claims Ratio has dropped higher than Gross Incurred Claims ratio for the segment implying higher earned

premium for the Health industry over the previous years. Others

Others

2.7%

2.7%

Gross & Net Incurred Claims

Chart 4.5.2 Gross & Net Incurred Claims Micro Insurance Agent

Agent

Micro Insurance

Chart 4.5.2

0.0%

Ratio - Health, Personal Accident & Travel

Ratio - Health, P ersonal Accident & T ravel 0.0%

Individual Agents

Individual Agents

28.9%

28.9%

110% 106.1%

Direct Business- Ot…

Direct Business- Ot…

30.8%

100.3% 30.8%

98.4%

100% 95.6% 97.0%

93.9%

92.0%

89.6% 90.3%

94.9%

Loss ratio (%) 85.9% 86.0% 86.7% 91.9% 89.1%

90%

80%

80.7% 81.8% 84.4% 81.6%

78.2%

Direct Business- Int…

Direct Business- Int…

70% 1.3%

1.3%

Corporate Agents-Bank

Corporate Agents-Bank

1 11.6%

1.6%

Referral Arrangement

Referral Arrangement

60% 0.0%

0.0%

2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18 2018-19

Corporate Agents- Others

Corporate Agents- Others

Year

3.1%

Brokers

Brokers 3.1%

Gross Incurred Claims Ratio Net Incurred Claims Ratio 21.5%

21.5%

Source: Council Compilation as per source

data submitted by companies

Chart 4.5.5 GDPI Breakup on Categories - Health & Accident

Chart 4.5.3 25,000

Chart 4.5.2 Rural vs Urban Premium - Health & Accident

Rural Premium

Rural Premium

20,524

5.8%

5.8%

20,000

18,319

15,000

₹ In Crores 10,000

5,843 5,402

5,000

803

-

Health-Retail Health -Group Health-Government Overseas Medical Personal Accident

Schemes Insurance

GDPI

Urban Premium

Urban Premium Source: Council Compilation as per source Source: Council Compilation as per source

94.2%

94.2% data submitted by companies data submitted by companies

100 101