Page 35 - Insurance Times December 2021

P. 35

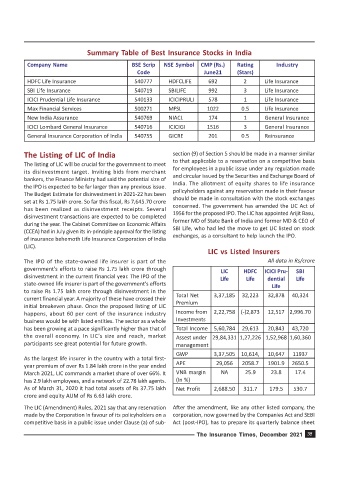

Summary Table of Best Insurance Stocks in India

Company Name BSE Scrip NSE Symbol CMP (Rs.) Rating Industry

Code June21 (Stars)

HDFC Life Insurance 540777 HDFCLIFE 692 2 Life Insurance

SBI Life Insurance 540719 SBILIFE 992 3 Life Insurance

ICICI Prudential Life Insurance 540133 ICICIPRULI 578 1 Life Insurance

Max Financial Services 500271 MFSL 1022 0.5 Life Insurance

New India Assurance 540769 NIACL 174 1 General Insurance

ICICI Lombard General Insurance 540716 ICICIGI 1516 3 General Insurance

General Insurance Corporation of India 540755 GICRE 201 0.5 Reinsurance

The Listing of LIC of India section (9) of Section 5 should be made in a manner similar

to that applicable to a reservation on a competitive basis

The listing of LIC will be crucial for the government to meet

for employees in a public issue under any regulation made

its disinvestment target. Inviting bids from merchant

bankers, the Finance Ministry had said the potential size of and circular issued by the Securities and Exchange Board of

the IPO is expected to be far larger than any previous issue. India. The allotment of equity shares to life insurance

The Budget Estimate for disinvestment in 2021-22 has been policyholders against any reservation made in their favour

set at Rs 1.75 lakh crore. So far this fiscal, Rs 7,645.70 crore should be made in consultation with the stock exchanges

has been realized as disinvestment receipts. Several concerned. The government has amended the LIC Act of

disinvestment transactions are expected to be completed 1956 for the proposed IPO. The LIC has appointed Arijit Basu,

during the year. The Cabinet Committee on Economic Affairs former MD of State Bank of India and former MD & CEO of

(CCEA) had in July given its in-principle approval for the listing SBI Life, who had led the move to get LIC listed on stock

exchanges, as a consultant to help launch the IPO.

of insurance behemoth Life Insurance Corporation of India

(LIC).

LIC vs Listed Insurers

The IPO of the state-owned life insurer is part of the All data in Rs/crore

government's efforts to raise Rs 1.75 lakh crore through LIC HDFC ICICI Pru- SBI

disinvestment in the current financial year. The IPO of the Life Life dential Life

state-owned life insurer is part of the government's efforts Life

to raise Rs 1.75 lakh crore through disinvestment in the

current financial year. A majority of these have crossed their Total Net 3,37,185 32,223 32,878 40,324

initial breakeven phase. Once the proposed listing of LIC Premium

happens, about 60 per cent of the insurance industry Income from 2,22,758 (-)2,873 12,517 2,996.70

business would be with listed entities. The sector as a whole Investments

has been growing at a pace significantly higher than that of Total Income 5,60,784 29,613 20,843 43,720

the overall economy. In LIC's size and reach, market Assest under 29,84,331 1,27,226 1,52,968 1,60,360

participants see great potential for future growth. management

GWP 3,37,505 10,614, 10,647 11937

As the largest life insurer in the country with a total first-

year premium of over Rs 1.84 lakh crore in the year ended APE 29,056 2058.7 1901.9 2650.5

March 2021, LIC commands a market share of over 66%. It VNB margin NA 25.9 23.8 17.4

has 2.9 lakh employees, and a network of 22.78 lakh agents. (In %)

As of March 31, 2020 it had total assets of Rs 37.75 lakh Net Profit 2,688.50 311.7 179.5 530.7

crore and equity AUM of Rs 6.63 lakh crore.

The LIC (Amendment) Rules, 2021 say that any reservation After the amendment, like any other listed company, the

made by the Corporation in favour of its policyholders on a corporation, now governed by the Companies Act and SEBI

competitive basis in a public issue under Clause (a) of sub- Act (post-IPO), has to prepare its quarterly balance sheet

The Insurance Times, December 2021 35