Page 41 - A Level Business Studies - Financial Analysis Tasks

P. 41

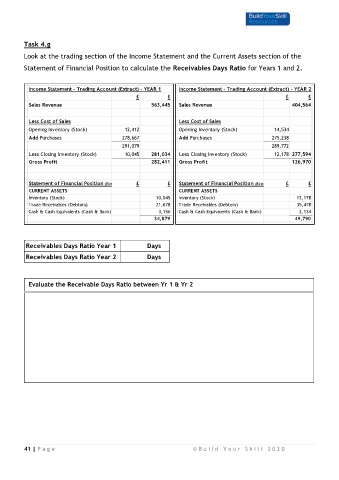

Task 4.g

Look at the trading section of the Income Statement and the Current Assets section of the

Statement of Financial Position to calculate the Receivables Days Ratio for Years 1 and 2.

Income Statement - Trading Account (Extract) - YEAR 1 Income Statement - Trading Account (Extract) - YEAR 2

£ £ £ £

Sales Revenue 563,445 Sales Revenue 404,564

Less Cost of Sales Less Cost of Sales

Opening Inventory (Stock) 12,412 Opening Inventory (Stock) 14,534

Add Purchases 278,667 Add Purchases 275,238

291,079 289,772

Less Closing Inventory (Stock) 10,045 281,034 Less Closing Inventory (Stock) 12,178 277,594

Gross Profit 282,411 Gross Profit 126,970

Statement of Financial Position (Extract) £ £ Statement of Financial Position (Extract) £ £

CURRENT ASSETS CURRENT ASSETS

Inventory (Stock) 10,045 Inventory (Stock) 12,178

Trade Receivables (Debtors) 21,678 Trade Receivables (Debtors) 35,478

Cash & Cash Equivalents (Cash & Bank) 3,156 Cash & Cash Equivalents (Cash & Bank) 2,134

34,879 49,790

Receivables Days Ratio Year 1 Days

Receivables Days Ratio Year 2 Days

Evaluate the Receivable Days Ratio between Yr 1 & Yr 2

41 | P a g e © B u i l d Y o u r S k i l l 2 0 2 0