Page 38 - A Level Business Studies - Financial Analysis Tasks

P. 38

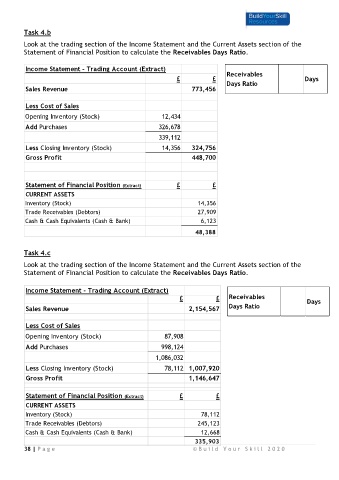

Task 4.b

Look at the trading section of the Income Statement and the Current Assets section of the

Statement of Financial Position to calculate the Receivables Days Ratio.

Income Statement - Trading Account (Extract)

£ £ Receivables Days

Days Ratio

Sales Revenue 773,456

Less Cost of Sales

Opening Inventory (Stock) 12,434

Add Purchases 326,678

339,112

Less Closing Inventory (Stock) 14,356 324,756

Gross Profit 448,700

Statement of Financial Position (Extract) £ £

CURRENT ASSETS

Inventory (Stock) 14,356

Trade Receivables (Debtors) 27,909

Cash & Cash Equivalents (Cash & Bank) 6,123

48,388

Task 4.c

Look at the trading section of the Income Statement and the Current Assets section of the

Statement of Financial Position to calculate the Receivables Days Ratio.

Income Statement - Trading Account (Extract)

£ £ Receivables Days

Sales Revenue 2,154,567 Days Ratio

Less Cost of Sales

Opening Inventory (Stock) 87,908

Add Purchases 998,124

1,086,032

Less Closing Inventory (Stock) 78,112 1,007,920

Gross Profit 1,146,647

Statement of Financial Position (Extract) £ £

CURRENT ASSETS

Inventory (Stock) 78,112

Trade Receivables (Debtors) 245,123

Cash & Cash Equivalents (Cash & Bank) 12,668

335,903

38 | P a g e © B u i l d Y o u r S k i l l 2 0 2 0