Page 39 - A Level Business Studies - Financial Analysis Tasks

P. 39

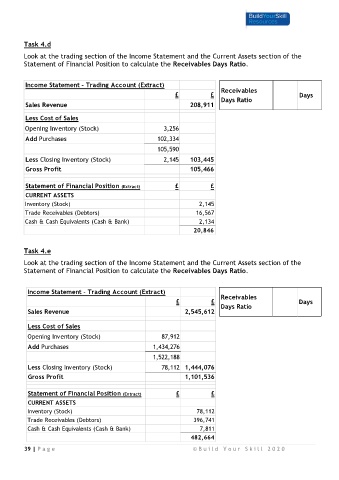

Task 4.d

Look at the trading section of the Income Statement and the Current Assets section of the

Statement of Financial Position to calculate the Receivables Days Ratio.

Income Statement - Trading Account (Extract)

Receivables

£ £ Days Ratio Days

Sales Revenue 208,911

Less Cost of Sales

Opening Inventory (Stock) 3,256

Add Purchases 102,334

105,590

Less Closing Inventory (Stock) 2,145 103,445

Gross Profit 105,466

Statement of Financial Position (Extract) £ £

CURRENT ASSETS

Inventory (Stock) 2,145

Trade Receivables (Debtors) 16,567

Cash & Cash Equivalents (Cash & Bank) 2,134

20,846

Task 4.e

Look at the trading section of the Income Statement and the Current Assets section of the

Statement of Financial Position to calculate the Receivables Days Ratio.

Income Statement - Trading Account (Extract)

Receivables

£ £ Days

Days Ratio

Sales Revenue 2,545,612

Less Cost of Sales

Opening Inventory (Stock) 87,912

Add Purchases 1,434,276

1,522,188

Less Closing Inventory (Stock) 78,112 1,444,076

Gross Profit 1,101,536

Statement of Financial Position (Extract) £ £

CURRENT ASSETS

Inventory (Stock) 78,112

Trade Receivables (Debtors) 396,741

Cash & Cash Equivalents (Cash & Bank) 7,811

482,664

39 | P a g e © B u i l d Y o u r S k i l l 2 0 2 0