Page 42 - A Level Business Studies - Financial Analysis Tasks

P. 42

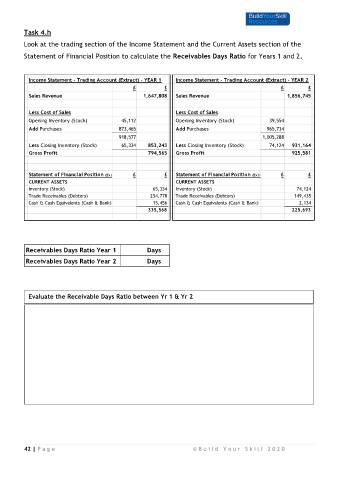

Task 4.h

Look at the trading section of the Income Statement and the Current Assets section of the

Statement of Financial Position to calculate the Receivables Days Ratio for Years 1 and 2.

Income Statement - Trading Account (Extract) - YEAR 1 Income Statement - Trading Account (Extract) - YEAR 2

£ £ £ £

Sales Revenue 1,647,808 Sales Revenue 1,856,745

Less Cost of Sales Less Cost of Sales

Opening Inventory (Stock) 45,112 Opening Inventory (Stock) 39,554

Add Purchases 873,465 Add Purchases 965,734

918,577 1,005,288

Less Closing Inventory (Stock) 65,334 853,243 Less Closing Inventory (Stock) 74,124 931,164

Gross Profit 794,565 Gross Profit 925,581

Statement of Financial Position (Extract) £ £ Statement of Financial Position (Extract) £ £

CURRENT ASSETS CURRENT ASSETS

Inventory (Stock) 65,334 Inventory (Stock) 74,124

Trade Receivables (Debtors) 254,778 Trade Receivables (Debtors) 149,435

Cash & Cash Equivalents (Cash & Bank) 15,456 Cash & Cash Equivalents (Cash & Bank) 2,134

335,568 225,693

Receivables Days Ratio Year 1 Days

Receivables Days Ratio Year 2 Days

Evaluate the Receivable Days Ratio between Yr 1 & Yr 2

42 | P a g e © B u i l d Y o u r S k i l l 2 0 2 0