Page 200 - C:\Users\Adik\Documents\Flip PDF Professional\Marketer PPT LR\

P. 200

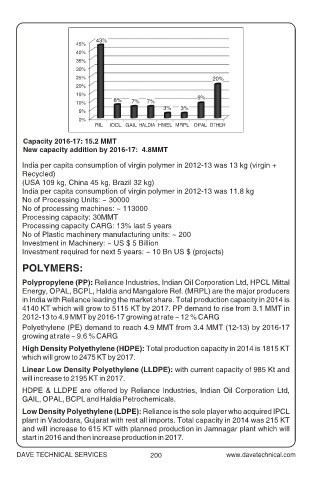

Capacity 2016-17: 15.2 MMT

New capacity addition by 2016-17: 4.8MMT

India per capita consumption of virgin polymer in 2012-13 was 13 kg (virgin +

Recycled)

(USA 109 kg, China 45 kg, Brazil 32 kg)

India per capita consumption of virgin polymer in 2012-13 was 11.8 kg

No of Processing Units: ~ 30000

No of processing machines: ~ 113000

Processing capacity: 30MMT

Processing capacity CARG: 13% last 5 years

No of Plastic machinery manufacturing units: ~ 200

Investment in Machinery: ~ US $ 5 Billion

Investment required for next 5 years: ~ 10 Bn US $ (projects)

POLYMERS:

Polypropylene (PP): Reliance Industries, Indian Oil Corporation Ltd, HPCL Mittal

Energy, OPAL, BCPL, Haldia and Mangalore Ref. (MRPL) are the major producers

in India with Reliance leading the market share. Total production capacity in 2014 is

4140 KT which will grow to 5115 KT by 2017. PP demand to rise from 3.1 MMT in

2012-13 to 4.9 MMT by 2016-17 growing at rate ~ 12 % CARG

Polyethylene (PE) demand to reach 4.9 MMT from 3.4 MMT (12-13) by 2016-17

growing at rate ~ 9.6 % CARG

High Density Polyethylene (HDPE): Total production capacity in 2014 is 1815 KT

which will grow to 2475 KT by 2017.

Linear Low Density Polyethylene (LLDPE): with current capacity of 985 Kt and

will increase to 2195 KT in 2017.

HDPE & LLDPE are offered by Reliance Industries, Indian Oil Corporation Ltd,

GAIL, OPAL, BCPL and Haldia Petrochemicals.

Low Density Polyethylene (LDPE): Reliance is the sole player who acquired IPCL

plant in Vadodara, Gujarat with rest all imports. Total capacity in 2014 was 215 KT

and will increase to 615 KT with planned production in Jamnagar plant which will

start in 2016 and then increase production in 2017.

DAVE TECHNICAL SERVICES 200 www.davetechnical.com