Page 11 - Watkins Associated Industries, Inc - 2022 Benefits Guide

P. 11

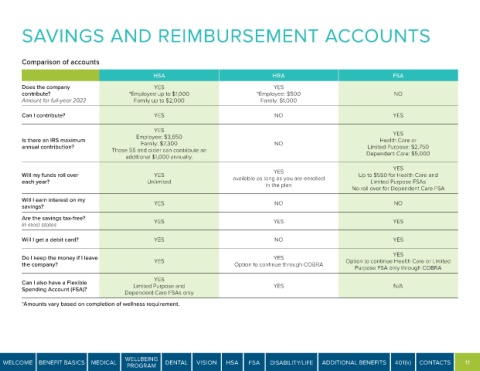

SAVINGS AND REIMBURSEMENT ACCOUNTS

Comparison of accounts

HSA HRA FSA

Does the company YES YES

contribute? *Employee up to $1,000 *Employee: $500 NO

Amount for full-year 2022 Family up to $2,000 Family: $1,000

Can I contribute? YES NO YES

YES YES

Is there an IRS maximum Employee: $3,650 Health Care or

annual contribution? Family: $7,300 NO Limited Purpose: $2,750

Those 55 and older can contribute an

additional $1,000 annually. Dependent Care: $5,000

YES

Will my funds roll over YES YES Up to $550 for Health Care and

each year? Unlimited available as long as you are enrolled Limited Purpose FSAs

in the plan

No roll over for Dependent Care FSA

Will I earn interest on my

savings? YES NO NO

Are the savings tax-free?

In most states YES YES YES

Will I get a debit card? YES NO YES

Do I keep the money if I leave YES YES

the company? YES Option to continue through COBRA Option to continue Health Care or Limited

Purpose FSA only through COBRA

Can I also have a Flexible YES

Spending Account (FSA)? Limited Purpose and YES N/A

Dependent Care FSAs only

*Amounts vary based on completion of wellness requirement.

WELLBEING

WELCOME BENEFIT BASICS MEDICAL DENTAL VISION HSA FSA DISABILITY/LIFE ADDITIONAL BENEFITS 401(k) CONTACTS 11

PROGRAM