Page 7 - Genesis Care 2022 Benefit Guide

P. 7

Medical & Spending Voluntary Additional

Contents Prescription Dental Vision Accounts Life & AD&D Disability Benefits 401(k) Information Contacts

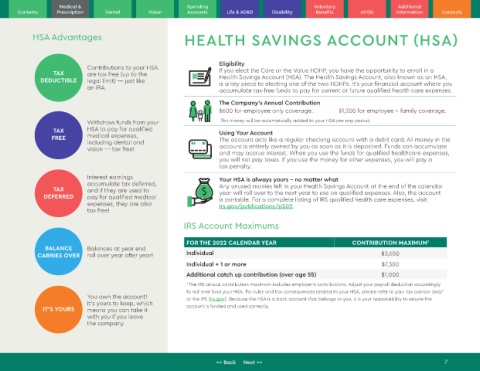

HSA Advantages HEALTH SAVINGS ACCOUNT (HSA)

Eligibility

Contributions to your HSA If you elect the Core or the Value HDHP, you have the opportunity to enroll in a

TAX are tax free (up to the

DEDUCTIBLE legal limit) — just like Health Savings Account (HSA). The Health Savings Account, also known as an HSA,

is a key piece to electing one of the two HDHPs. It’s your financial account where you

an IRA. accumulate tax-free funds to pay for current or future qualified health care expenses.

The Company’s Annual Contribution

$600 for employee only coverage. $1,200 for employee + family coverage.

Withdraw funds from your This money will be automatically added to your HSA per pay period.

TAX HSA to pay for qualified Using Your Account

FREE medical expenses, The account acts like a regular checking account with a debit card. All money in the

including dental and

vision — tax free! account is entirely owned by you as soon as it is deposited. Funds can accumulate

and may accrue interest. When you use the funds for qualified healthcare expenses,

you will not pay taxes. If you use the money for other expenses, you will pay a

tax penalty.

Interest earnings Your HSA is always yours - no matter what

accumulate tax deferred, Any unused monies left in your Health Savings Account at the end of the calendar

TAX and if they are used to year will roll over to the next year to use on qualified expenses. Also, the account

DEFERRED pay for qualified medical is portable. For a complete listing of IRS qualified health care expenses, visit

expenses, they are also irs.gov/publications/p502.

tax free!

IRS Account Maximums

FOR THE 2022 CALENDAR YEAR CONTRIBUTION MAXIMUM 1

BALANCE Balances at year end

CARRIES OVER roll over year after year! Individual $3,650

Individual + 1 or more $7,300

Additional catch up contribution (over age 55) $1,000

1 The IRS annual contribution maximum includes employer’s contributions. Adjust your payroll deduction accordingly

to not over fund your HSA. For rules and tax consequences related to your HSA, please refer to your tax advisor and/

You own the account! or the IRS (irs.gov). Because the HSA is a bank account that belongs to you, it is your responsibility to ensure the

It’s yours to keep, which

IT'S YOURS means you can take it account is funded and used correctly.

with you if you leave

the company.

<< Back Next >> 7