Page 21 - 2022 Benegit Guide

P. 21

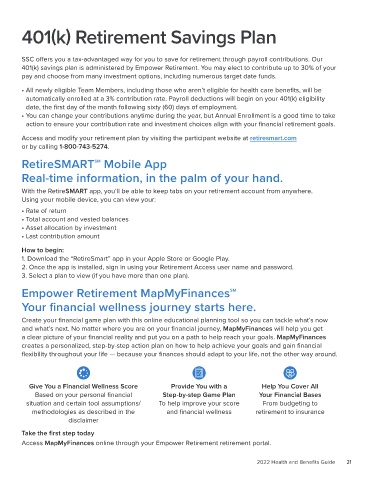

401(k) Retirement Savings Plan

SSC offers you a tax-advantaged way for you to save for retirement through payroll contributions. Our

401(k) savings plan is administered by Empower Retirement. You may elect to contribute up to 30% of your

pay and choose from many investment options, including numerous target date funds.

• All newly eligible Team Members, including those who aren’t eligible for health care benefits, will be

automatically enrolled at a 3% contribution rate. Payroll deductions will begin on your 401(k) eligibility

date, the first day of the month following sixty (60) days of employment.

• You can change your contributions anytime during the year, but Annual Enrollment is a good time to take

action to ensure your contribution rate and investment choices align with your financial retirement goals.

Access and modify your retirement plan by visiting the participant website at retiresmart.com

or by calling 1-800-743-5274.

RetireSMART Mobile App

SM

Real-time information, in the palm of your hand.

With the RetireSMART app, you’ll be able to keep tabs on your retirement account from anywhere.

Using your mobile device, you can view your:

• Rate of return

• Total account and vested balances

• Asset allocation by investment

• Last contribution amount

How to begin:

1. Download the “RetireSmart” app in your Apple Store or Google Play.

2. Once the app is installed, sign in using your Retirement Access user name and password.

3. Select a plan to view (if you have more than one plan).

Empower Retirement MapMyFinances SM

Your financial wellness journey starts here.

Create your financial game plan with this online educational planning tool so you can tackle what’s now

and what’s next. No matter where you are on your financial journey, MapMyFinances will help you get

a clear picture of your financial reality and put you on a path to help reach your goals. MapMyFinances

creates a personalized, step-by-step action plan on how to help achieve your goals and gain financial

flexibility throughout your life — because your finances should adapt to your life, not the other way around.

Give You a Financial Wellness Score Provide You with a Help You Cover All

Based on your personal financial Step-by-step Game Plan Your Financial Bases

situation and certain tool assumptions/ To help improve your score From budgeting to

methodologies as described in the and financial wellness retirement to insurance

disclaimer

Take the first step today

Access MapMyFinances online through your Empower Retirement retirement portal.

2022 Health and Benefits Guide 21