Page 14 - HutsonWood-2023-24-Benefit Guide

P. 14

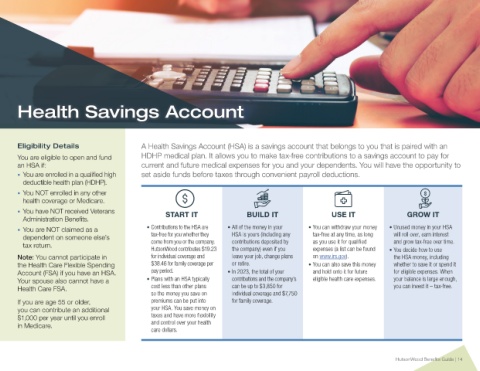

Health Savings Account

Eligibility Details A Health Savings Account (HSA) is a savings account that belongs to you that is paired with an

You are eligible to open and fund HDHP medical plan. It allows you to make tax-free contributions to a savings account to pay for

an HSA if: current and future medical expenses for you and your dependents. You will have the opportunity to

• You are enrolled in a qualified high set aside funds before taxes through convenient payroll deductions.

deductible health plan (HDHP).

• You NOT enrolled in any other

health coverage or Medicare.

• You have NOT received Veterans START IT BUILD IT USE IT GROW IT

Administration Benefits.

• You are NOT claimed as a • Contributions to the HSA are • All of the money in your • You can withdraw your money • Unused money in your HSA

dependent on someone else’s tax-free for you whether they HSA is yours (including any tax-free at any time, as long will roll over, earn interest

as you use it for qualified

contributions deposited by

and grow tax-free over time.

come from you or the company.

tax return.

HutsonWood contributes $19.23 the company) even if you expenses (a list can be found • You decide how to use

Note: You cannot participate in for individual coverage and leave your job, change plans on www.irs.gov). the HSA money, including

the Health Care Flexible Spending $38.46 for family coverage per or retire. • You can also save this money whether to save it or spend it

Account (FSA) if you have an HSA. pay period. • In 2023, the total of your and hold onto it for future for eligible expenses. When

Your spouse also cannot have a • Plans with an HSA typically contributions and the company’s eligible health care expenses. your balance is large enough,

Health Care FSA. cost less than other plans can be up to $3,850 for you can invest it – tax-free.

so the money you save on individual coverage and $7,750

If you are age 55 or older, premiums can be put into for family coverage.

you can contribute an additional your HSA. You save money on

$1,000 per year until you enroll taxes and have more flexibility

in Medicare. and control over your health

care dollars.

HutsonWood Benefits Guide | 14