Page 9 - HutsonWood-2023-24-Benefit Guide

P. 9

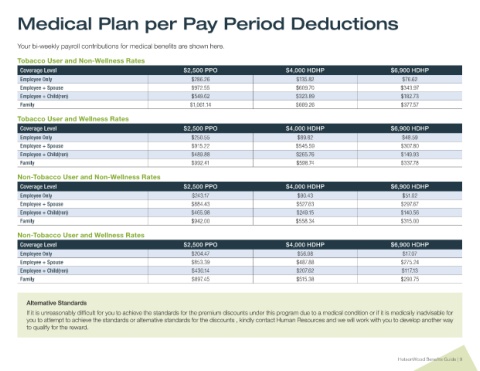

Medical Plan per Pay Period Deductions

Your bi-weekly payroll contributions for medical benefits are shown here.

Tobacco User and Non-Wellness Rates

Coverage Level $2,500 PPO $4,000 HDHP $6,900 HDHP

Employee Only $286.26 $135.82 $76.62

Employee + Spouse $972.55 $609.70 $343.97

Employee + Child(ren) $549.62 $323.89 $182.73

Family $1,061.14 $669.26 $377.57

Tobacco User and Wellness Rates

Coverage Level $2,500 PPO $4,000 HDHP $6,900 HDHP

Employee Only $250.55 $89.82 $48.59

Employee + Spouse $915.22 $545.59 $307.80

Employee + Child(ren) $489.88 $265.76 $149.93

Family $992.41 $598.74 $337.78

Non-Tobacco User and Non-Wellness Rates

Coverage Level $2,500 PPO $4,000 HDHP $6,900 HDHP

Employee Only $243.17 $90.43 $51.02

Employee + Spouse $884.43 $527.63 $297.67

Employee + Child(ren) $465.98 $249.15 $140.56

Family $942.00 $558.34 $315.00

Non-Tobacco User and Wellness Rates

Coverage Level $2,500 PPO $4,000 HDHP $6,900 HDHP

Employee Only $204.47 $56.08 $17.07

Employee + Spouse $853.39 $487.88 $275.24

Employee + Child(ren) $430.14 $207.62 $117.13

Family $897.45 $515.38 $290.75

Alternative Standards

If it is unreasonably difficult for you to achieve the standards for the premium discounts under this program due to a medical condition or if it is medically inadvisable for

you to attempt to achieve the standards or alternative standards for the discounts , kindly contact Human Resources and we will work with you to develop another way

to qualify for the reward.

HutsonWood Benefits Guide | 9