Page 19 - HutsonWood-2023-24-Benefit Guide

P. 19

Life and AD&D Insurance

HutsonWood provides basic life and AD&D insurance for employees and offers voluntary insurance options for employees and their dependents.

Basic Life and AD&D Insurance

Life insurance is an important part of your financial wellbeing, especially if others depend on you for support. The company provides basic life insurance at

no cost to all active, full-time employees working a minimum of 30 hours per week. You will be eligible for coverage on the first of the month following your

eligibility window. The company-paid life insurance is equal to $25,000 and pays double for AD&D.

Note: Benefit reduction for Employee Basic Life Insurance begins at age 65.

Voluntary Life and AD&D Insurance

You may choose to purchase additional life and AD&D coverage through New York Life for yourself and your dependents at affordable group rates. Rates are

based on age and the coverage level chosen.

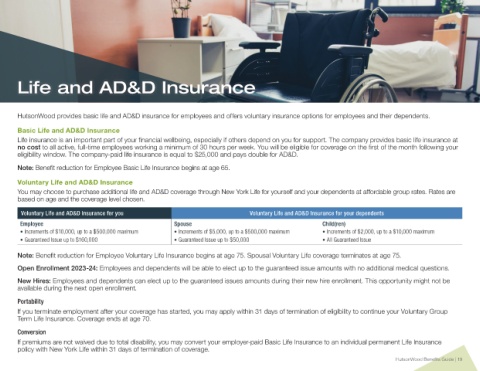

Voluntary Life and AD&D Insurance for you Voluntary Life and AD&D Insurance for your dependents

Employee Spouse Child(ren)

• Increments of $10,000, up to a $500,000 maximum • Increments of $5,000, up to a $500,000 maximum • Increments of $2,000, up to a $10,000 maximum

• Guaranteed Issue up to $160,000 • Guaranteed Issue up to $50,000 • All Guaranteed Issue

Note: Benefit reduction for Employee Voluntary Life Insurance begins at age 75. Spousal Voluntary Life coverage terminates at age 75.

Open Enrollment 2023-24: Employees and dependents will be able to elect up to the guaranteed issue amounts with no additional medical questions.

New Hires: Employees and dependents can elect up to the guaranteed issues amounts during their new hire enrollment. This opportunity might not be

available during the next open enrollment.

Portability

If you terminate employment after your coverage has started, you may apply within 31 days of termination of eligibility to continue your Voluntary Group

Term Life Insurance. Coverage ends at age 70.

Conversion

If premiums are not waived due to total disability, you may convert your employer-paid Basic Life Insurance to an individual permanent Life Insurance

policy with New York Life within 31 days of termination of coverage.

HutsonWood Benefits Guide | 19