Page 10 - TruckPro-2022-Benefit Guide-FINAL

P. 10

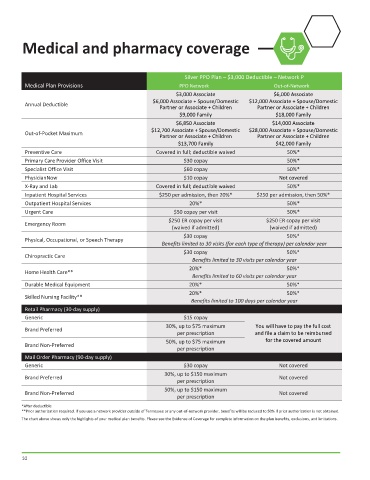

Medical and pharmacy coverage

Silver PPO Plan – $3,000 Deductible – Network P

Medical Plan Provisions PPO Network Out-of-Network

$3,000 Associate $6,000 Associate

$6,000 Associate + Spouse/Domestic $12,000 Associate + Spouse/Domestic

Annual Deductible

Partner or Associate + Children Partner or Associate + Children

$9,000 Family $18,000 Family

$6,850 Associate $14,000 Associate

$12,700 Associate + Spouse/Domestic $28,000 Associate + Spouse/Domestic

Out-of-Pocket Maximum

Partner or Associate + Children Partner or Associate + Children

$13,700 Family $42,000 Family

Preventive Care Covered in full; deductible waived 50%*

Primary Care Provider Office Visit $30 copay 50%*

Specialist Office Visit $60 copay 50%*

PhysicianNow $10 copay Not covered

X-Ray and Lab Covered in full; deductible waived 50%*

Inpatient Hospital Services $250 per admission, then 20%* $250 per admission, then 50%*

Outpatient Hospital Services 20%* 50%*

Urgent Care $50 copay per visit 50%*

$250 ER copay per visit $250 ER copay per visit

Emergency Room

(waived if admitted) (waived if admitted)

$30 copay 50%*

Physical, Occupational, or Speech Therapy

Benefits limited to 30 visits (for each type of therapy) per calendar year

$30 copay 50%*

Chiropractic Care

Benefits limited to 30 visits per calendar year

20%* 50%*

Home Health Care**

Benefits limited to 60 visits per calendar year

Durable Medical Equipment 20%* 50%*

20%* 50%*

Skilled Nursing Facility**

Benefits limited to 100 days per calendar year

Retail Pharmacy (30-day supply)

Generic $15 copay

30%, up to $75 maximum You will have to pay the full cost

Brand Preferred

per prescription and file a claim to be reimbursed

50%, up to $75 maximum for the covered amount

Brand Non-Preferred

per prescription

Mail Order Pharmacy (90-day supply)

Generic $30 copay Not covered

30%, up to $150 maximum

Brand Preferred Not covered

per prescription

50%, up to $150 maximum

Brand Non-Preferred Not covered

per prescription

*After deductible

**Prior authorization required. If you use a network provider outside of Tennessee or any out-of-network provider, benefits will be reduced to 50% if prior authorization is not obtained.

The chart above shows only the highlights of your medical plan benefits. Please see the Evidence of Coverage for complete information on the plan benefits, exclusions, and limitations.

10