Page 23 - OpenX 2022 Book of Benefits

P. 23

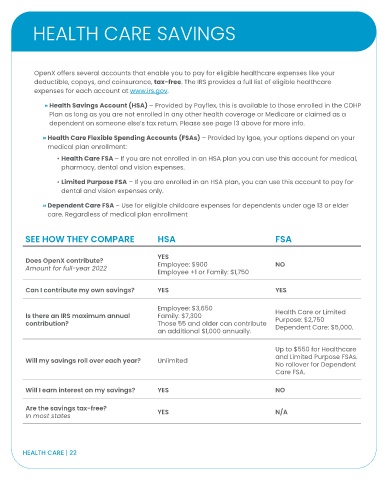

HEALTH CARE SAVINGS

OpenX offers several accounts that enable you to pay for eligible healthcare expenses like your

deductible, copays, and coinsurance, tax-free. The IRS provides a full list of eligible healthcare

expenses for each account at www.irs.gov.

» Health Savings Account (HSA) – Provided by Payflex, this is available to those enrolled in the CDHP

Plan as long as you are not enrolled in any other health coverage or Medicare or claimed as a

dependent on someone else’s tax return. Please see page 13 above for more info.

» Health Care Flexible Spending Accounts (FSAs) – Provided by Igoe, your options depend on your

medical plan enrollment:

• Health Care FSA – If you are not enrolled in an HSA plan you can use this account for medical,

pharmacy, dental and vision expenses.

• Limited Purpose FSA – If you are enrolled in an HSA plan, you can use this account to pay for

dental and vision expenses only.

» Dependent Care FSA – Use for eligible childcare expenses for dependents under age 13 or elder

care. Regardless of medical plan enrollment

SEE HOW THEY COMPARE HSA FSA

YES

Does OpenX contribute?

Employee: $900 NO

Amount for full-year 2022

Employee +1 or Family: $1,750

Can I contribute my own savings? YES YES

Employee: $3,650

Health Care or Limited

Is there an IRS maximum annual Family: $7,300

Purpose: $2,750

contribution? Those 55 and older can contribute

Dependent Care: $5,000.

an additional $1,000 annually.

Up to $550 for Healthcare

and Limited Purpose FSAs.

Will my savings roll over each year? Unlimited

No rollover for Dependent

Care FSA.

Will I earn interest on my savings? YES NO

Are the savings tax-free?

YES N/A

In most states

HEALTH CARE | 22