Page 12 - 2022 SoFi - August Open Enrollment

P. 12

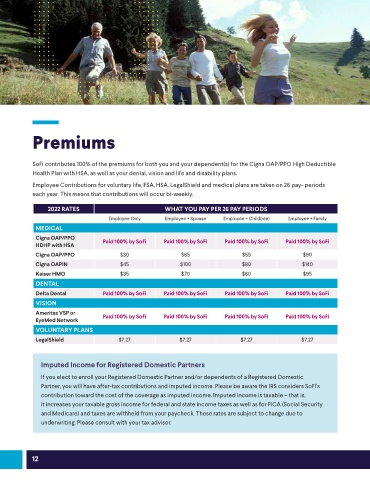

Premiums

SoFi contributes 100% of the premiums for both you and your dependent(s) for the Cigna OAP/PPO High Deductible

Health Plan with HSA, as well as your dental, vision and life and disability plans.

Employee Contributions for voluntary life, FSA, HSA, LegalShield and medical plans are taken on 26 pay- periods

each year. This means that contributions will occur bi-weekly.

2022 RATES WHAT YOU PAY PER 26 PAY PERIODS

Employee Only Employee + Spouse Employee + Child(ren) Employee + Family

MEDICAL

Cigna OAP/PPO Paid 100% by SoFi Paid 100% by SoFi Paid 100% by SoFi Paid 100% by SoFi

HDHP with HSA

Cigna OAP/PPO $30 $65 $55 $90

Cigna OAPIN $45 $100 $80 $140

Kaiser HMO $35 $70 $60 $95

DENTAL

Delta Dental Paid 100% by SoFi Paid 100% by SoFi Paid 100% by SoFi Paid 100% by SoFi

VISION

Ameritas VSP or Paid 100% by SoFi Paid 100% by SoFi Paid 100% by SoFi Paid 100% by SoFi

EyeMed Network

VOLUNTARY PLANS

LegalShield $7.27 $7.27 $7.27 $7.27

Imputed Income for Registered Domestic Partners

If you elect to enroll your Registered Domestic Partner and/or dependents of a Registered Domestic

Partner, you will have after-tax contributions and imputed income. Please be aware the IRS considers SoFi’s

contribution toward the cost of the coverage as imputed income. Imputed income is taxable – that is,

it increases your taxable gross income for federal and state income taxes as well as for FICA (Social Security

and Medicare) and taxes are withheld from your paycheck. These rates are subject to change due to

underwriting. Please consult with your tax advisor.

12