Page 168 - GB SUBJECTS NEW - ALL PAGE NO

P. 168

`

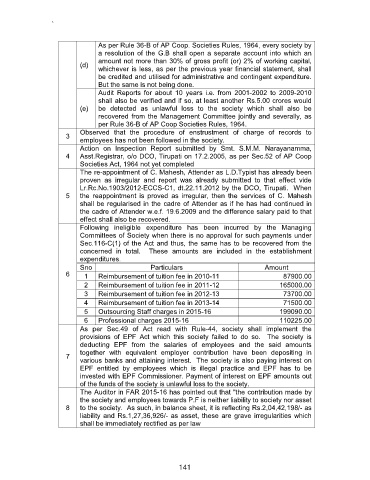

As per Rule 36-B of AP Coop. Societies Rules, 1964, every society by

a resolution of the G.B shall open a separate account into which an

amount not more than 30% of gross profit (or) 2% of working capital,

(d)

whichever is less, as per the previous year financial statement, shall

be credited and utilised for administrative and contingent expenditure.

But the same is not being done.

Audit Reports for about 10 years i.e. from 2001-2002 to 2009-2010

shall also be verified and if so, at least another Rs.5.00 crores would

(e) be detected as unlawful loss to the society which shall also be

recovered from the Management Committee jointly and severally, as

per Rule 36-B of AP Coop Societies Rules, 1964.

Observed that the procedure of enstrustment of charge of records to

3

employees has not been followed in the society.

Action on Inspection Report submitted by Smt. S.M.M. Narayanamma,

4 Asst.Registrar, o/o DCO, Tirupati on 17.2.2005, as per Sec.52 of AP Coop

Societies Act, 1964 not yet completed

The re-appointment of C. Mahesh, Attender as L.D.Typist has already been

proven as irregular and report was already submitted to that effect vide

Lr.Rc.No.1903/2012-ECCS-C1, dt.22.11.2012 by the DCO, Tirupati. When

5 the reappointment is proved as irregular, then the services of C. Mahesh

shall be regularised in the cadre of Attender as if he has had continued in

the cadre of Attender w.e.f. 19.6.2009 and the difference salary paid to that

effect shall also be recovered.

Following ineligible expenditure has been incurred by the Managing

Committees of Society when there is no approval for such payments under

Sec.116-C(1) of the Act and thus, the same has to be recovered from the

concerned in total. These amounts are included in the establishment

expenditures.

Sno Particulars Amount

6 1 Reimbursement of tuition fee in 2010-11 87900.00

2 Reimbursement of tuition fee in 2011-12 165000.00

3 Reimbursement of tuition fee in 2012-13 73700.00

4 Reimbursement of tuition fee in 2013-14 71500.00

5 Outsourcing Staff charges in 2015-16 199090.00

6 Professional charges 2015-16 110225.00

As per Sec.49 of Act read with Rule-44, society shall implement the

provisions of EPF Act which this society failed to do so. The society is

deducting EPF from the salaries of employees and the said amounts

together with equivalent employer contribution have been depositing in

7

various banks and attaining interest. The society is also paying interest on

EPF entitled by employees which is illegal practice and EPF has to be

invested with EPF Commissioner. Payment of interest on EPF amounts out

of the funds of the society is unlawful loss to the society.

The Auditor in FAR 2015-16 has pointed out that "the contribution made by

the society and employees towards P.F is neither liability to society nor asset

8 to the society. As such, in balance sheet, it is reflecting Rs.2,04,42,198/- as

liability and Rs.1,27,36,926/- as asset, these are grave irregularities which

shall be immediately rectified as per law

141