Page 171 - GB SUBJECTS NEW - ALL PAGE NO

P. 171

`

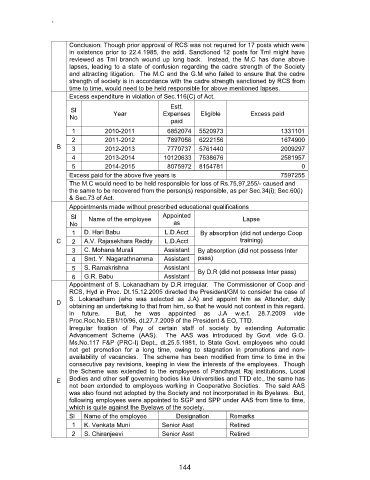

Conclusion: Though prior approval of RCS was not required for 17 posts which were

in existence prior to 22.4.1985, the addl. Sanctioned 12 posts for Tml might have

reviewed as Tml branch wound up long back. Instead, the M.C has done above

lapses, leading to a state of confusion regarding the cadre strength of the Society

and attracting litigation. The M.C and the G.M who failed to ensure that the cadre

strength of society is in accordance with the cadre strength sanctioned by RCS from

time to time, would need to be held responsible for above mentioned lapses.

Excess expenditure in violation of Sec.116(C) of Act.

Estt.

Sl

No Year Expenses Eligible Excess paid

paid

1 2010-2011 6852074 5520973 1331101

2 2011-2012 7897056 6222156 1674900

B 3 2012-2013 7770737 5761440 2009297

4 2013-2014 10120633 7538676 2581957

5 2014-2015 8075972 8154781 0

Excess paid for the above five years is 7597255

The M.C would need to be held responsible for loss of Rs.75,97,255/- caused and

the same to be recovered from the person(s) responsible, as per Sec.34(i); Sec.60(i)

& Sec.73 of Act.

Appointments made without prescribed educational qualifications

Sl Name of the employee Appointed Lapse

No as

1 D. Hari Babu L.D.Acct By absorption (did not undergo Coop

C 2 A.V. Rajasekhara Reddy L.D.Acct training)

3 C. Mohana Murali Assistant By absorption (did not possess Inter

4 Smt. Y. Nagarathnamma Assistant pass)

5 S. Ramakrishna Assistant By D.R (did not possess Inter pass)

6 G.R. Babu Assistant

Appointment of S. Lokanadham by D.R irregular. The Commissioner of Coop and

RCS, Hyd in Proc. Dt.15.12.2005 directed the President/GM to consider the case of

S. Lokanadham (who was selected as J.A) and appoint him as Attender, duly

D

obtaining an undertaking to that from him, so that he would not contest in this regard,

in future. But, he was appointed as J.A w.e.f. 28.7.2009 vide

Proc.Roc.No.EB1/10/96, dt.27.7.2009 of the President & EO, TTD.

Irregular fixation of Pay of certain staff of society by extending Automatic

Advancement Scheme (AAS). The AAS was introduced by Govt. vide G.O.

Ms.No.117 F&P (PRC-I) Dept., dt.25.5.1981, to State Govt. employees who could

not get promotion for a long time, owing to stagnation in promotions and non-

availability of vacancies. The scheme has been modified from time to time in the

consecutive pay revisions, keeping in view the interests of the employees. Though

the Scheme was extended to the employees of Panchayat Raj institutions, Local

E Bodies and other self governing bodies like Universities and TTD etc., the same has

not been extended to employees working in Cooperative Societies. The said AAS

was also found not adopted by the Society and not incorporated in its Byelaws. But,

following employees were appointed to SGP and SPP under AAS from time to time,

which is quite against the Byelaws of the society.

Sl Name of the employee Designation Remarks

1 K. Venkata Muni Senior Asst Retired

2 S. Chiranjeevi Senior Asst Retired

144