Page 66 - GB SUBJECTS NEW - ALL PAGE NO

P. 66

`

Sub No.8:– Reduction of Rate of Interest on Secured Loans and Addl. HBL from

existing 11% to 10%

File No.EB4/1/TTD ECCS/2022

The TTD Employees Coop. Credit Society Ltd., Tirupati is providing secured

Loans, Addl. House Building Loans and Emergency Loans to its members. For the past

several decades, the rate of interest on loans was charged @ 12% per annum.

Thereupon, Managing Committee placed necessary proposals for reduction of rate of

interest from 12% to 11% before the General Body of the society, wherein the General

Body approved for the proposal vide Res.No.6, dt.1.11.2021 and subsequently, the

Cooperative Department had also amended the byelaws of our society suitably.

While so, the original byelaws of the society was found missing and the affairs of

the society were as per provisional byelaws supplied by the Cooperative Department in

the year 2018. Thereupon, our society had submitted proposals for registration of

comprehensive byelaws prepared afresh, with the approval of the General Body. The

Cooperative Department had registered en-bloc amendments of Byelaws of TTD

Employees Coop. Credit Society Ltd., Tirupati in July-2023 (registration of latest byelaws

of the society) vide Rc.No.626/2023.D1, dt.4.7.2023 of the District Cooperative Officer,

Tirupati and the same was communicated to our society by the Divisional Cooperative

Officer, Tirupati vide Endt.Rc.No.738/23.C2, dt.6.7.2023.

In pursuance of Byelaw No.36 of above byelaws, interest on loans granted by the

society shall for the present charged at the rate as decided by the Managing Committee

from time to time. In pursuance of provision in byelaws, the Managing Committee vide

Res.No.620, dt.7.7.2023 resolved to continue the rate of interest @ 11% p.a. As per

byelaw No.52(a), out of 11% of interest amount charged on loans from members, the

society will utilize 10% of interest in business of the society and the remaining 1% of

interest amount shall be credited to Members Welfare Fund.

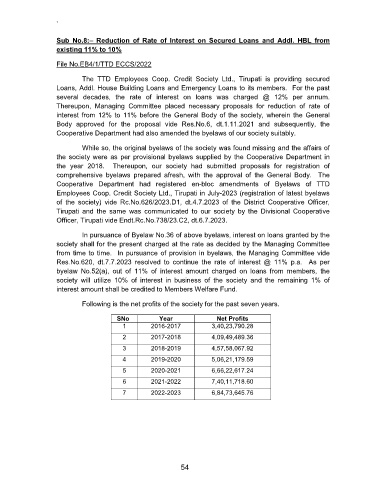

Following is the net profits of the society for the past seven years.

SNo Year Net Profits

1 2016-2017 3,40,23,790.28

2 2017-2018 4,09,49,489.36

3 2018-2019 4,57,58,067.92

4 2019-2020 5,06,21,179.59

5 2020-2021 6,66,22,617.24

6 2021-2022 7,40,11,718.60

7 2022-2023 6,84,73,645.76

54