Page 133 - Theoretical and Practical Interpretation of Investment Attractiveness

P. 133

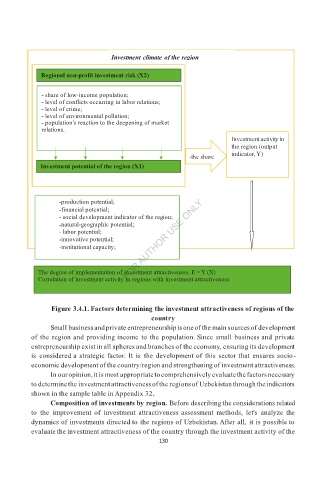

Investment climate of the region

Regional non-profit investment risk (X2)

˗ share of low-income population;

˗ level of conflicts occurring in labor relations;

˗ level of crime;

˗ level of environmental pollution;

˗ population's reaction to the deepening of market

relations.

Investment activity in

the region (output

˗the share indicator, Y)

Investment potential of the region (X1)

˗production potential;

˗financial potential;

˗ social development indicator of the region;

˗natural-geographic potential;

˗ labor potential;

˗innovative potential;

˗institutional capacity;

The degree of implementation of investment attractiveness, E = Y (X)

Correlation of investment activity in regions with investment attractiveness

Figure 3.4.1. Factors determining the investment attractiveness of regions of the

country

Small business and private entrepreneurship is one of the main sources of development

of the region and providing income to the population. Since small business and private

entrepreneurship exist in all spheres and branches of the economy, ensuring its development

is considered a strategic factor. It is the development of this sector that ensures socio-

economic development of the country/region and strengthening of investment attractiveness.

In our opinion, it is most appropriate to comprehensively evaluate the factors necessary

to determine the investment attractiveness of the regions of Uzbekistan through the indicators

shown in the sample table in Appendix 32.

Composition of investments by region. Before describing the considerations related

to the improvement of investment attractiveness assessment methods, let's analyze the

dynamics of investments directed to the regions of Uzbekistan. After all, it is possible to

evaluate the investment attractiveness of the country through the investment activity of the

130