Page 6 - GLNG Week 33 2022

P. 6

GLNG AFRICA GLNG

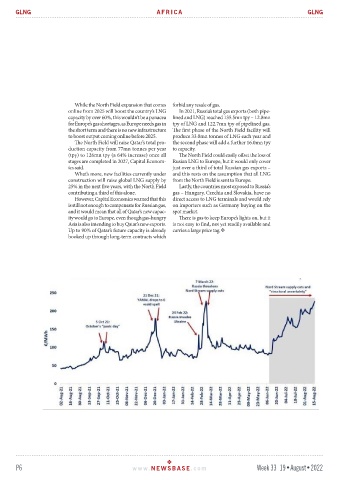

While the North Field expansion that comes forbid any resale of gas.

online from 2025 will boost the country’s LNG In 2021, Russia’s total gas exports (both pipe-

capacity by over 60%, this wouldn’t be a panacea lined and LNG) reached 135.5mn tpy – 12.8mn

for Europe’s gas shortages, as Europe needs gas in tpy of LNG and 122.7mn tpy of pipelined gas.

the short term and there is no new infrastructure The first phase of the North Field facility will

to boost output coming online before 2025. produce 33.0mn tonnes of LNG each year and

The North Field will raise Qatar’s total pro- the second phase will add a further 16.0mn tpy

duction capacity from 77mn tonnes per year to capacity.

(tpy) to 126mn tpy (a 64% increase) once all The North Field could easily offset the loss of

stages are completed in 2027, Capital Econom- Rusian LNG to Europe, but it would only cover

ics said. just over a third of total Russian gas exports –

What’s more, new facilities currently under and this rests on the assumption that all LNG

construction will raise global LNG supply by from the North Field is sent to Europe.

25% in the next five years, with the North Field Lastly, the countries most exposed to Russia’s

contributing a third of this alone. gas – Hungary, Czechia and Slovakia, have no

However, Capital Economics warned that this direct access to LNG terminals and would rely

is still not enough to compensate for Russian gas, on importers such as Germany buying on the

and it would mean that all of Qatar’s new capac- spot market.

ity would go to Europe, even though gas-hungry There is gas to keep Europe’s lights on, but it

Asia is also intending to buy Qatar’s new exports. is not easy to find, not yet readily available and

Up to 90% of Qatar’s future capacity is already carries a large price tag.

booked up through long-term contracts which

P6 www. NEWSBASE .com Week 33 19•August•2022