Page 9 - LatAmOil Week 36 2022

P. 9

LatAmOil GUYANA LatAmOil

However, it revised its figure upward in light of and signed by President Irfaan Ali last Decem-

fluctuations on world crude oil markets. ber. Prior to that date, Guyana’s oil revenues had

In related news, the Bank of Guyana has been held in a special account by the US Federal

released a new monthly financial statement Reserve Bank of New York.

showing that the Natural Reserve Fund (NRF),

Guyana’s sovereign wealth fund, had a balance

of GYD198,064,374,000 ($946,312,653.73) as

of the end of August. The statement noted that

the government had not made any withdraw-

als from the NRF in August but had deposited

GYD21,380,376,000 ($102,151,234.68) and

had earned GYD374,687,000 ($1,790,180.85)

in interest in the same month.

Guyana has earned more than $1.3bn from

oil exports since it began extracting crude from

the Liza-1 field in December 2019. Since it made

its first deposit in the NRF, it has made only two

withdrawals in two tranches of $200mn each.

The NRF was officially established under the

mandate of a law passed by Guyana’s parliament Bank of Guyana governor Gobind Ganga (Photo: DPI.gov.gy)

BRAZIL

Petrobras mulls possibility of expanding

CCS plans to include third-party services

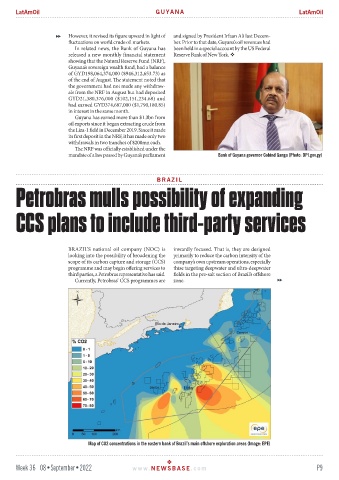

BRAZIL’S national oil company (NOC) is inwardly focused. That is, they are designed

looking into the possibility of broadening the primarily to reduce the carbon intensity of the

scope of its carbon capture and storage (CCS) company’s own upstream operations, especially

programme and may begin offering services to thise targeting deepwater and ultra-deepwater

third parties, a Petrobras representative has said. fields in the pre-salt section of Brazil’s offshore

Currently, Petrobras’ CCS programmes are zone.

Map of CO2 concentrations in the eastern bank of Brazil’s main offshore exploration areas (Image: EPE)

Week 36 08•September•2022 www. NEWSBASE .com P9