Page 9 - FSUOGM Week 16 2021

P. 9

FSUOGM COMMENTARY FSUOGM

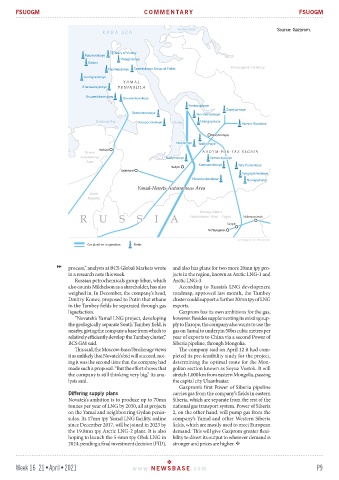

Source: Gazprom.

process,” analysts at BCS Global Markets wrote and also has plans for two more 20mn tpy pro-

in a research note this week. jects in the region, known as Arctic LNG-1 and

Russian petrochemicals group Sibur, which Arctic LNG-3.

also counts Mikhelson as a shareholder, has also According to Russia’s LNG development

weighed in. In December, the company’s head, roadmap, approved last month, the Tambey

Dmitry Konov, proposed to Putin that ethane cluster could support a further 20mn tpy of LNG

in the Tambey fields be separated through gas exports.

liquefaction. Gazprom has its own ambitions for the gas,

“Novatek’s Yamal LNG project, developing however. Besides supplementing its existing sup-

the geologically separate South Tambey field, is ply to Europe, the company also wants to use the

nearby, giving the company a base from which to gas on Yamal to underpin 50bn cubic metres per

relatively efficiently develop the Tambey cluster,” year of exports to China via a second Power of

BCS GM said. Siberia pipeline, through Mongolia.

This said, the Moscow-based brokerage views The company said on April 12 it had com-

it as unlikely that Novatek’s bid will succeed, not- pleted its pre-feasibility study for the project,

ing it was the second time that the company had determining the optimal route for the Mon-

made such a proposal. “But the effort shows that golian section known as Soyuz Vostok. It will

the company is still thinking very big,” its ana- stretch 1,000 km from eastern Mongolia, passing

lysts said. the capital city Ulaanbaatar.

Gazprom’s first Power of Siberia pipeline

Differing supply plans carries gas from the company’s fields in eastern

Novatek’s ambition is to produce up to 70mn Siberia, which are separate from the rest of the

tonnes per year of LNG by 2030, all at projects national gas transport system. Power of Siberia

on the Yamal and neighbouring Gydan penin- 2, on the other hand, will pump gas from the

sulas. Its 17mn tpy Yamal LNG facility, online company’s Yamal and other Western Siberia

since December 2017, will be joined in 2023 by fields, which are mostly used to meet European

the 19.8mn tpy Arctic LNG-2 plant. It is also demand. This will give Gazprom greater flexi-

hoping to launch the 5-6mn tpy Obsk LNG in bility to divert its output to wherever demand is

2024, pending a final investment decision (FID), stronger and prices are higher.

Week 16 21•April•2021 www. NEWSBASE .com P9