Page 7 - LatAmOil Week 10 2021

P. 7

LatAmOil COMMENTARY LatAmOil

Indeed, Prince Abdulaziz said that Saudi’s vol- to comply with restrictions. While Oil Minis-

untary cut would be phased out “at our conven- ter Jabbar has repeatedly said that the country

ience”, adding that the Kingdom was “not in a would comply with its quota while making

hurry” to ramp up output levels. compensatory cuts to make up for historical

While Saudi Arabia failed to fully achieve its non-compliance, achieving this has so far been

promised reduction, it accounted for the major- elusive.

ity of an OPEC+-wide 870,000 bpd cut during Meanwhile, as the UAE’s Abu Dhabi National

February compared to March, according to a Oil Co. (ADNOC) seeks to expand its oil pro-

Reuters survey of OPEC sources. duction and exert greater influence, reports

At present, OPEC+ output is seen sitting have surfaced about plans to end the UAE’s

at 43.6mn bpd throughout the second half of OPEC membership. Given the way in which the

the year, factoring in the Russian and Kazakh market has been propped up by the actions of

upticks. However, several countries have shown OPEC+, any such move is unlikely in the short

signs of creaking over the past few months. term, however, as Abu Dhabi and Riyadh to toe-

With Iraq’s economic struggles showing lit- to-toe in the oil and now the nascent hydrogen

tle signs of abating, Baghdad has come under markets, the former’s ambitions could become

criticism from other members for its failure problematic for the cartel..

MEXICO

Valero to shift all Mexican fuel

shipments away from rail routes

US-BASED Valero is looking to gain more con-

trol over its fuel transportation and distribution

routes in Mexico, a company representative said

last week.

According to Carlos Garcia, the head of Vale-

ro’s Mexican operations, the firm is looking to

designate two seaports on the Gulf coast as the

only points of entry for its petroleum product

deliveries to the country. As such, he told S&P

Global Platts, it will phase out the practice of

delivering fuel via railway lines that cross from

Texas into northern Mexico.

Taking this step will give the firm more con-

trol over its own production, he commented.

“Our goal is to supply the Mexican market with

fuels that have been produced at our refineries

through a network that we control, so that we

can ensure the quality of the product and relia-

bility of the supply,” he said.

Valero has been sending refined petroleum

products to Mexico via rail since 2018, he noted.

This route allowed for fuels from the company’s

refinery in McKee, Texas, to be transported

from Houston to terminals in the Mexican bor-

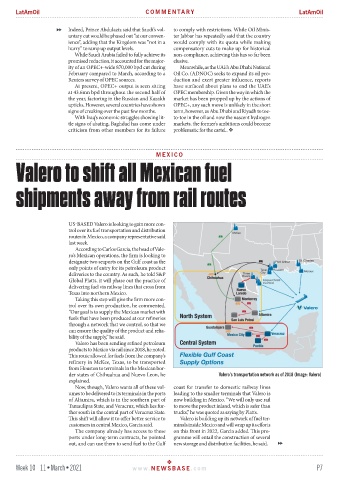

der states of Chihuahua and Nuevo Leon, he Valero’s transportation network as of 2018 (Image: Valero)

explained.

Now, though, Valero wants all of these vol- coast for transfer to domestic railway lines

umes to be delivered to its terminals in the ports leading to the smaller terminals that Valero is

of Altamira, which is in the southern part of now building in Mexico. “We will only use rail

Tamaulipas State, and Veracruz, which lies fur- to move the product inland, which is safer than

ther south in the central part of Veracruz State. trucks,” he was quoted as saying by Platts.

This shift will allow it to offer better service to Valero is building up its network of fuel ter-

customers in central Mexico, Garcia said. minals inside Mexico and will wrap up its efforts

The company already has access to these on this front in 2022, Garcia added. This pro-

ports under long-term contracts, he pointed gramme will entail the construction of several

out, and can use them to send fuel to the Gulf new storage and distribution facilities, he said.

Week 10 11•March•2021 www. NEWSBASE .com P7