Page 12 - DMEA Week 50 2021

P. 12

DMEA PIPELINES DMEA

Ugandan MPs approve EACOP

Special Provisions Bill 2021

AFRICA UGANDA moved one step closer towards petroleum, environment, immigration, insur-

launching commercial hydrocarbon production ance, land and tax laws.

last week, when members of Parliament voted to Even so, once Museveni signs the bill, Uganda

approve a bill designed to facilitate construction will be able to join Tanzania, which passed sim-

of the East African Crude Oil Pipeline (EACOP). ilar enabling and operationalising legislation

Legislators debated all sections of the draft in August 2021, in laying a foundation for the

law, known as the EACOP Special Provisions Bill construction of the EACOP pipeline. The pro-

2021, on December 8. They then scheduled the ject is seen as crucial to development of oilfields

vote for December 9 after reaching agreement in western Uganda near Lake Albert, as it will

on all clauses. Now that the vote has taken place, establish an export route for that production

Parliament can send the bill to President Yoweri stream.

Museveni for signature. According to previous reports, the EACOP

As of press time, Museveni had not said when pipeline will be built by a consortium in which

he expected to finalise the legislation. TotalEnergies (France) is serving as the operator

The EACOP Special Provisions Bill 2021 aims with a 62% stake.

to enable and operationalise certain provisions The remaining equity will be divided between

of the Inter-Governmental Agreement (IGA) China National Offshore Oil Corp. (CNOOC),

signed between Uganda and Tanzania earlier with 8%; Uganda National Oil Co. (UNOC),

this year, as well as the Host Government Agree- with 15%, and Tanzania Petroleum Develop-

ment (HGA) signed between Uganda and the ment Corp. (TPDC), with 15%.

EACOP group. Both TotalEnergies and CNOOC are

It will allow the French-led consortium to involved in developing the oilfields that will

meet certain preconditions for beginning con- provide throughput for the pipeline; the former

struction by filling gaps in Uganda’s existing legal company serves as operator of Tilenga, while the

regime that do not make adequate provision for latter is leading work at Kingfisher.

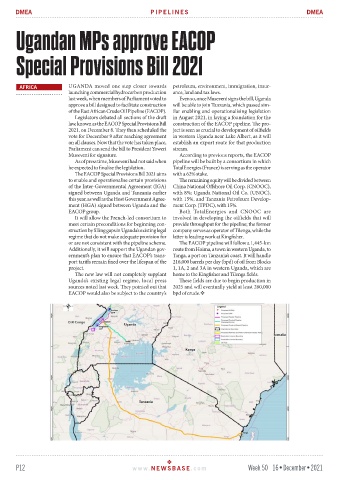

or are not consistent with the pipeline scheme. The EACOP pipeline will follow a 1,445-km

Additionally, it will support the Ugandan gov- route from Hoima, a town in western Uganda, to

ernment’s plan to ensure that EACOP’s trans- Tanga, a port on Tanzania’s coast. It will handle

port tariffs remain fixed over the lifespan of the 216,000 barrels per day (bpd) of oil from Blocks

project. 1, 1A, 2 and 3A in western Uganda, which are

The new law will not completely supplant home to the Kingfisher and Tilenga fields.

Uganda’s existing legal regime, local press These fields are due to begin production in

sources noted last week. They pointed out that 2025 and will eventually yield at least 260,000

EACOP would also be subject to the country’s bpd of crude.

P12 www. NEWSBASE .com Week 50 16•December•2021