Page 50 - NobleCon21

P. 50

Financials

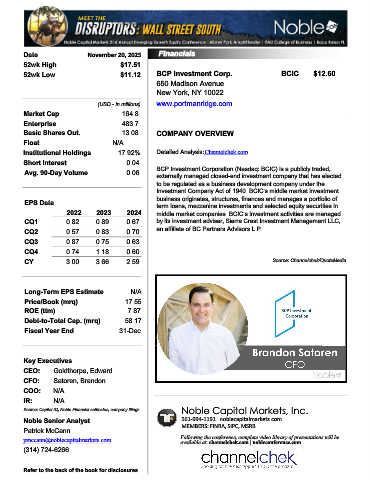

Date November 20, 2025 Financials

52wk High $17.51

52wk Low $11.12 BCP Investment Corp. BCIC $12.60

650 Madison Avenue

New York, NY 10022

(USD - in millions) www.portmanridge.com

Market Cap 164.8

Enterprise 483.7

Basic Shares Out. 13.08 COMPANY OVERVIEW

Float N/A

Institutional Holdings 17.92% Detailed Analysis:Channelchek.com

Short Interest 0.04

Avg. 90-Day Volume 0.06 BCP Investment Corporation (Nasdaq: BCIC) is a publicly traded,

externally managed closed-end investment company that has elected

to be regulated as a business development company under the

Investment Company Act of 1940. BCIC’s middle market investment

EPS Data business originates, structures, finances and manages a portfolio of

term loans, mezzanine investments and selected equity securities in

2022 2023 2024 middle market companies. BCIC’s investment activities are managed

CQ1 0.82 0.89 0.67 by its investment adviser, Sierra Crest Investment Management LLC,

CQ2 0.57 0.83 0.70 an affiliate of BC Partners Advisors L.P.

CQ3 0.87 0.75 0.63

CQ4 0.74 1.18 0.60

CY 3.00 3.66 2.59 Source: Channelchek/QuoteMedia

Long-Term EPS Estimate N/A

Price/Book (mrq) 17.55

ROE (ttm) 7.87

Debt-to-Total Cap. (mrq) 58.17

Fiscal Year End 31-Dec

650 Madison ANew York NY 10022

Key Executives

CEO: Goldthorpe, Edward

CFO: Satoren, Brandon

COO: N/A

IR: N/A

Noble Capital Markets, Inc.

Source: Capital IQ, Noble Financial estimates, company filings

Noble Senior Analyst 561-994-1191 noblecapitalmarkets.com

Patrick McCann MEMBERS: FINRA, SIPC, MSRB

pmccann@noblecapitalmarkets.com Following the conference, complete video library of presentations will be

available at: channelchek.com | nobleconference.com

(314) 724-6266

Refer to the back of the book for disclosures