Page 15 - FIN435 RHB vs BPMB

P. 15

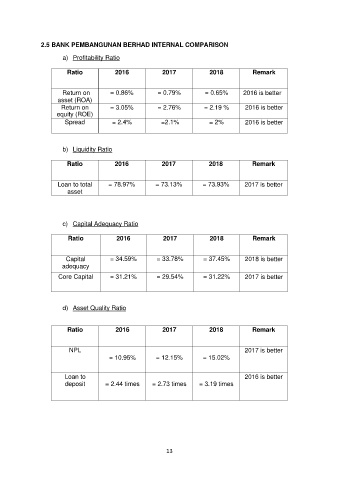

2.5 BANK PEMBANGUNAN BERHAD INTERNAL COMPARISON

a) Profitability Ratio

Ratio 2016 2017 2018 Remark

Return on = 0.86% = 0.79% = 0.65% 2016 is better

asset (ROA)

Return on = 3.05% = 2.76% = 2.19 % 2016 is better

equity (ROE)

Spread = 2.4% =2.1% = 2% 2016 is better

b) Liquidity Ratio

Ratio 2016 2017 2018 Remark

Loan to total = 78.97% = 73.13% = 73.93% 2017 is better

asset

c) Capital Adequacy Ratio

Ratio 2016 2017 2018 Remark

Capital = 34.59% = 33.78% = 37.45% 2018 is better

adequacy

Core Capital = 31.21% = 29.54% = 31.22% 2017 is better

d) Asset Quality Ratio

Ratio 2016 2017 2018 Remark

NPL 2017 is better

= 10.95% = 12.15% = 15.02%

Loan to 2016 is better

deposit = 2.44 times = 2.73 times = 3.19 times

13