Page 3 - DA_XII_Accounts_09_2021_Partnership-03-com

P. 3

Accountancy – XII_2021-09

March 26, 2020

partners? (Choose the correct answer)

(A) A `60,000; B `60,000; C Nil

(B) A `90,000; B `30,000; C Nil

(C) A `40,000; B `40,000 and C `40,000

(D) A `50,000; B `50,000 and C `50,000

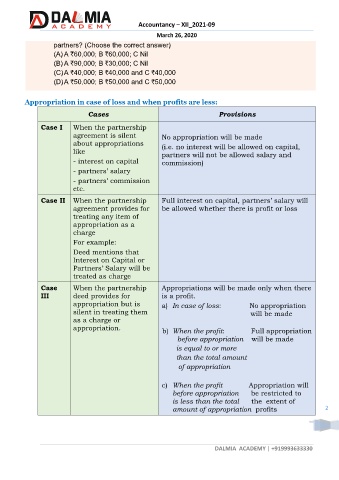

Appropriation in case of loss and when profits are less:

Cases Provisions

Case I When the partnership

agreement is silent No appropriation will be made

about appropriations (i.e. no interest will be allowed on capital,

like partners will not be allowed salary and

- interest on capital commission)

- partners’ salary

- partners’ commission

etc.

Case II When the partnership Full interest on capital, partners’ salary will

agreement provides for be allowed whether there is profit or loss

treating any item of

appropriation as a

charge

For example:

Deed mentions that

Interest on Capital or

Partners’ Salary will be

treated as charge

Case When the partnership Appropriations will be made only when there

III deed provides for is a profit.

appropriation but is a) In case of loss: No appropriation

silent in treating them will be made

as a charge or

appropriation. b) When the profit: Full appropriation

before appropriation will be made

is equal to or more

than the total amount

of appropriation

c) When the profit Appropriation will

before appropriation be restricted to

is less than the total the extent of

amount of appropriation profits 2

DALMIA ACADEMY | +919993633330