Page 8 - DA_XII_Accounts_09_2021_Partnership-03-com

P. 8

Accountancy – XII_2021-09

March 26, 2020

(A) `48,000

(B) `60,000

(C) `72,000

(D) `24,000

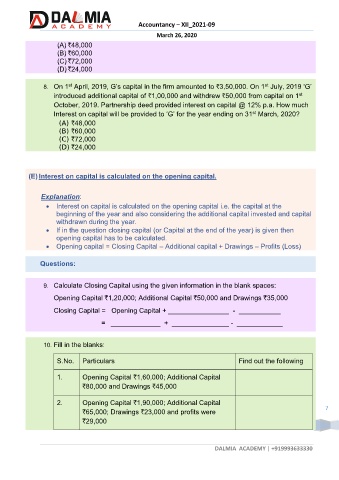

8. On 1 April, 2019, G’s capital in the firm amounted to `3,50,000. On 1 July, 2019 ‘G’

st

st

introduced additional capital of `1,00,000 and withdrew `50,000 from capital on 1 st

October, 2019. Partnership deed provided interest on capital @ 12% p.a. How much

st

Interest on capital will be provided to ‘G’ for the year ending on 31 March, 2020?

(A) `48,000

(B) `60,000

(C) `72,000

(D) `24,000

(E) Interest on capital is calculated on the opening capital.

Explanation:

• Interest on capital is calculated on the opening capital i.e. the capital at the

beginning of the year and also considering the additional capital invested and capital

withdrawn during the year.

• If in the question closing capital (or Capital at the end of the year) is given then

opening capital has to be calculated.

• Opening capital = Closing Capital – Additional capital + Drawings – Profits (Loss)

Questions:

9. Calculate Closing Capital using the given information in the blank spaces:

Opening Capital `1,20,000; Additional Capital `50,000 and Drawings `35,000

Closing Capital = Opening Capital + ________________ - ___________

= _____________ + _______________ - ____________

10. Fill in the blanks:

S.No. Particulars Find out the following

1. Opening Capital `1,60,000; Additional Capital

`80,000 and Drawings `45,000

2. Opening Capital `1,90,000; Additional Capital

`65,000; Drawings `23,000 and profits were 7

`29,000

DALMIA ACADEMY | +919993633330