Page 7 - DA_XII_Accounts_09_2021_Partnership-03-com

P. 7

Accountancy – XII_2021-09

March 26, 2020

Questions:

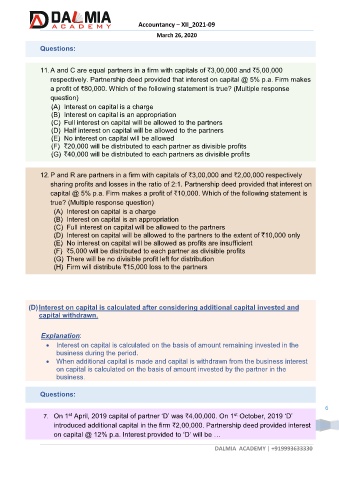

11. A and C are equal partners in a firm with capitals of `3,00,000 and `5,00,000

respectively. Partnership deed provided that interest on capital @ 5% p.a. Firm makes

a profit of `80,000. Which of the following statement is true? (Multiple response

question)

(A) Interest on capital is a charge

(B) Interest on capital is an appropriation

(C) Full interest on capital will be allowed to the partners

(D) Half interest on capital will be allowed to the partners

(E) No interest on capital will be allowed

(F) `20,000 will be distributed to each partner as divisible profits

(G) `40,000 will be distributed to each partners as divisible profits

12. P and R are partners in a firm with capitals of `3,00,000 and `2,00,000 respectively

sharing profits and losses in the ratio of 2:1. Partnership deed provided that interest on

capital @ 5% p.a. Firm makes a profit of `10,000. Which of the following statement is

true? (Multiple response question)

(A) Interest on capital is a charge

(B) Interest on capital is an appropriation

(C) Full interest on capital will be allowed to the partners

(D) Interest on capital will be allowed to the partners to the extent of `10,000 only

(E) No interest on capital will be allowed as profits are insufficient

(F) `5,000 will be distributed to each partner as divisible profits

(G) There will be no divisible profit left for distribution

(H) Firm will distribute `15,000 loss to the partners

(D) Interest on capital is calculated after considering additional capital invested and

capital withdrawn.

Explanation:

• Interest on capital is calculated on the basis of amount remaining invested in the

business during the period.

• When additional capital is made and capital is withdrawn from the business interest

on capital is calculated on the basis of amount invested by the partner in the

business.

Questions:

6

st

7. On 1 April, 2019 capital of partner ‘D’ was `4,00,000. On 1 October, 2019 ‘D’

st

introduced additional capital in the firm `2,00,000. Partnership deed provided interest

on capital @ 12% p.a. Interest provided to ‘D’ will be …

DALMIA ACADEMY | +919993633330