Page 5 - DA_XII_Accounts_09_2021_Partnership-03-com

P. 5

Accountancy – XII_2021-09

March 26, 2020

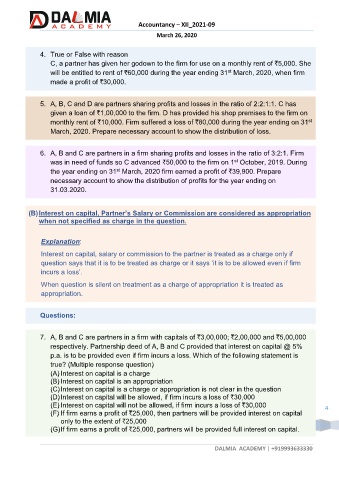

4. True or False with reason

C, a partner has given her godown to the firm for use on a monthly rent of `5,000. She

st

will be entitled to rent of `60,000 during the year ending 31 March, 2020, when firm

made a profit of `30,000.

5. A, B, C and D are partners sharing profits and losses in the ratio of 2:2:1:1. C has

given a loan of `1,00,000 to the firm. D has provided his shop premises to the firm on

monthly rent of `10,000. Firm suffered a loss of `80,000 during the year ending on 31 st

March, 2020. Prepare necessary account to show the distribution of loss.

6. A, B and C are partners in a firm sharing profits and losses in the ratio of 3:2:1. Firm

st

was in need of funds so C advanced `50,000 to the firm on 1 October, 2019. During

the year ending on 31 March, 2020 firm earned a profit of `39,900. Prepare

st

necessary account to show the distribution of profits for the year ending on

31.03.2020.

(B) Interest on capital, Partner’s Salary or Commission are considered as appropriation

when not specified as charge in the question.

Explanation:

Interest on capital, salary or commission to the partner is treated as a charge only if

question says that it is to be treated as charge or it says ‘it is to be allowed even if firm

incurs a loss’.

When question is silent on treatment as a charge of appropriation it is treated as

appropriation.

Questions:

7. A, B and C are partners in a firm with capitals of `3,00,000; `2,00,000 and `5,00,000

respectively. Partnership deed of A, B and C provided that interest on capital @ 5%

p.a. is to be provided even if firm incurs a loss. Which of the following statement is

true? (Multiple response question)

(A) Interest on capital is a charge

(B) Interest on capital is an appropriation

(C) Interest on capital is a charge or appropriation is not clear in the question

(D) Interest on capital will be allowed, if firm incurs a loss of `30,000

(E) Interest on capital will not be allowed, if firm incurs a loss of `30,000 4

(F) If firm earns a profit of `25,000, then partners will be provided interest on capital

only to the extent of `25,000

(G) If firm earns a profit of `25,000, partners will be provided full interest on capital.

DALMIA ACADEMY | +919993633330