Page 4 - DA_XII_Accounts_09_2021_Partnership-03-com

P. 4

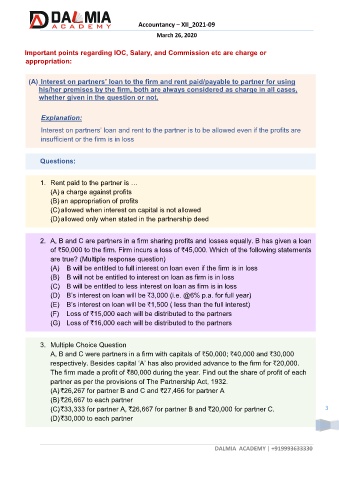

Accountancy – XII_2021-09

March 26, 2020

Important points regarding IOC, Salary, and Commission etc are charge or

appropriation:

(A) Interest on partners’ loan to the firm and rent paid/payable to partner for using

his/her premises by the firm, both are always considered as charge in all cases,

whether given in the question or not.

Explanation:

Interest on partners’ loan and rent to the partner is to be allowed even if the profits are

insufficient or the firm is in loss

Questions:

1. Rent paid to the partner is …

(A) a charge against profits

(B) an appropriation of profits

(C) allowed when interest on capital is not allowed

(D) allowed only when stated in the partnership deed

2. A, B and C are partners in a firm sharing profits and losses equally. B has given a loan

of `50,000 to the firm. Firm incurs a loss of `45,000. Which of the following statements

are true? (Multiple response question)

(A) B will be entitled to full interest on loan even if the firm is in loss

(B) B will not be entitled to interest on loan as firm is in loss

(C) B will be entitled to less interest on loan as firm is in loss

(D) B’s interest on loan will be `3,000 (i.e. @6% p.a. for full year)

(E) B’s interest on loan will be `1,500 ( less than the full interest)

(F) Loss of `15,000 each will be distributed to the partners

(G) Loss of `16,000 each will be distributed to the partners

3. Multiple Choice Question

A, B and C were partners in a firm with capitals of `50,000; `40,000 and `30,000

respectively. Besides capital ‘A’ has also provided advance to the firm for `20,000.

The firm made a profit of `80,000 during the year. Find out the share of profit of each

partner as per the provisions of The Partnership Act, 1932.

(A) `26,267 for partner B and C and `27,466 for partner A

(B) `26,667 to each partner

(C) `33,333 for partner A, `26,667 for partner B and `20,000 for partner C. 3

(D) `30,000 to each partner

DALMIA ACADEMY | +919993633330