Page 6 - DA_XII_Accounts_09_2021_Partnership-03-com

P. 6

Accountancy – XII_2021-09

March 26, 2020

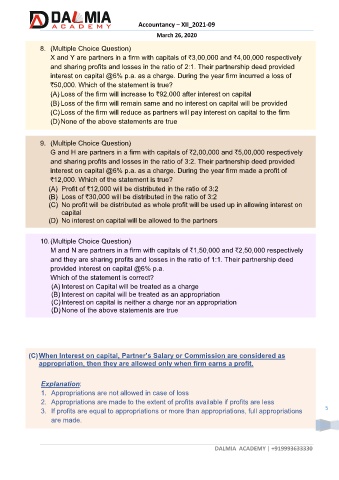

8. (Multiple Choice Question)

X and Y are partners in a firm with capitals of `3,00,000 and `4,00,000 respectively

and sharing profits and losses in the ratio of 2:1. Their partnership deed provided

interest on capital @6% p.a. as a charge. During the year firm incurred a loss of

`50,000. Which of the statement is true?

(A) Loss of the firm will increase to `92,000 after interest on capital

(B) Loss of the firm will remain same and no interest on capital will be provided

(C) Loss of the firm will reduce as partners will pay interest on capital to the firm

(D) None of the above statements are true

9. (Multiple Choice Question)

G and H are partners in a firm with capitals of `2,00,000 and `5,00,000 respectively

and sharing profits and losses in the ratio of 3:2. Their partnership deed provided

interest on capital @6% p.a. as a charge. During the year firm made a profit of

`12,000. Which of the statement is true?

(A) Profit of `12,000 will be distributed in the ratio of 3:2

(B) Loss of `30,000 will be distributed in the ratio of 3:2

(C) No profit will be distributed as whole profit will be used up in allowing interest on

capital

(D) No interest on capital will be allowed to the partners

10. (Multiple Choice Question)

M and N are partners in a firm with capitals of `1,50,000 and `2,50,000 respectively

and they are sharing profits and losses in the ratio of 1:1. Their partnership deed

provided interest on capital @6% p.a.

Which of the statement is correct?

(A) Interest on Capital will be treated as a charge

(B) Interest on capital will be treated as an appropriation

(C) Interest on capital is neither a charge nor an appropriation

(D) None of the above statements are true

(C) When Interest on capital, Partner’s Salary or Commission are considered as

appropriation, then they are allowed only when firm earns a profit.

Explanation:

1. Appropriations are not allowed in case of loss

2. Appropriations are made to the extent of profits available if profits are less

3. If profits are equal to appropriations or more than appropriations, full appropriations 5

are made.

DALMIA ACADEMY | +919993633330