Page 26 - Obligatory Zakat Made Easy

P. 26

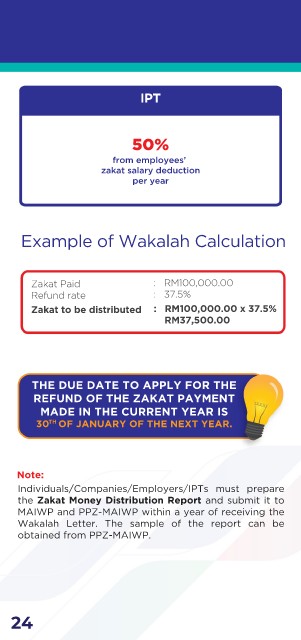

IPT

50%

from employees’

zakat salary deduction

per year

Example of Wakalah Calculation

Zakat Paid : RM100,000.00

Refund rate : 37.5%

Zakat to be distributed : RM100,000.00 x 37.5%

RM37,500.00

THE DUE DATE TO APPLY FOR THE

REFUND OF THE ZAKAT PAYMENT

MADE IN THE CURRENT YEAR IS

TH

30 OF JANUARY OF THE NEXT YEAR.

Note:

Individuals/Companies/Employers/IPTs must prepare

the Zakat Money Distribution Report and submit it to

MAIWP and PPZ-MAIWP within a year of receiving the

Wakalah Letter. The sample of the report can be

obtained from PPZ-MAIWP.

24