Page 57 - Small Business Taxes

P. 57

16:29 - 11-Jan-2023

Page 51 of 53

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

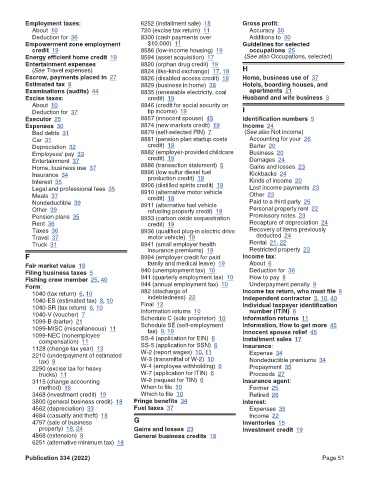

6252 (installment sale) 18

Employment taxes: Fileid: … tions/p334/2022/a/xml/cycle03/source Gross profit:

About 10 720 (excise tax return) 11 Accuracy 30

Deduction for 36 8300 (cash payments over Additions to 30

Empowerment zone employment $10,000) 11 Guidelines for selected

credit 19 8586 (low-income housing) 19 occupations 25

Energy efficient home credit 19 8594 (asset acquisition) 17 (See also Occupations, selected)

Entertainment expenses 8820 (orphan drug credit) 19

(See Travel expenses) 8824 (like-kind exchange) 17, 18 H

Escrow, payments placed in 27 8826 (disabled access credit) 19 Home, business use of 37

Estimated tax 8 8829 (business in home) 38 Hotels, boarding houses, and

Examinations (audits) 44 8835 (renewable electricity, coal apartments 21

Excise taxes: credit) 19 Husband and wife business 3

About 10 8846 (credit for social security on

Deduction for 37 tip income) 19 I

Executor 25 8857 (innocent spouse) 45 Identification numbers 5

Expenses 30 8874 (new markets credit) 19 Income 24

Bad debts 31 8879 (self-selected PIN) 7 (See also Not income)

Car 31 8881 (pension plan startup costs Accounting for your 26

Depreciation 32 credit) 19 Barter 20

Employees' pay 33 8882 (employer-provided childcare Business 20

Entertainment 37 credit) 19 Damages 24

Home, business use 37 8886 (transaction statement) 5 Gains and losses 23

Insurance 34 8896 (low sulfur diesel fuel Kickbacks 24

production credit) 19

Interest 35 8906 (distilled spirits credit) 19 Kinds of income 20

Legal and professional fees 35 8910 (alternative motor vehicle Lost income payments 23

Meals 37 credit) 18 Other 23

Nondeductible 39 8911 (alternative fuel vehicle Paid to a third party 26

Other 39 refueling property credit) 18 Personal property rent 22

Pension plans 35 8933 (carbon oxide sequestration Promissory notes 23

Rent 36 credit) 19 Recapture of depreciation 24

Taxes 36 8936 (qualified plug-in electric drive Recovery of items previously

Travel 37 motor vehicle) 19 deducted 24

Truck 31 8941 (small employer health Rental 21, 22

insurance premiums) 19 Restricted property 23

F 8994 (employer credit for paid Income tax:

Fair market value 18 family and medical leave) 19 About 6

Filing business taxes 5 940 (unemployment tax) 10 Deduction for 36

Fishing crew member 25, 40 941 (quarterly employment tax) 10 How to pay 8

Form: 944 (annual employment tax) 10 Underpayment penalty 9

1040 (tax return) 6, 10 982 (discharge of Income tax return, who must file 6

indebtedness) 22

1040-ES (estimated tax) 8, 10 Independent contractor 3, 10, 40

1040-SR (tax return) 6, 10 Final 12 Individual taxpayer identification

Information returns 10

number (ITIN) 6

1040-V (voucher) 7

1099-B (barter) 21 Schedule C (sole proprietor) 10 Information returns 11

Information, How to get more 45

Schedule SE (self-employment

1099-MISC (miscellaneous) 11 tax) 9, 10

1099-NEC (nonemployee SS-4 (application for EIN) 6 Innocent spouse relief 45

compensation) 11 Installment sales 17

1128 (change tax year) 13 SS-5 (application for SSN) 6 Insurance:

2210 (underpayment of estimated W-2 (report wages) 10, 11 Expense 34

tax) 9 W-3 (transmittal of W-2) 10 Nondeductible premiums 34

2290 (excise tax for heavy W-4 (employee withholding) 6 Prepayment 35

trucks) 11 W-7 (application for ITIN) 6 Proceeds 27

3115 (change accounting W-9 (request for TIN) 6 Insurance agent:

method) 16 When to file 10 Former 25

3468 (investment credit) 19 Which to file 10 Retired 26

3800 (general business credit) 18 Fringe benefits 34 Interest:

4562 (depreciation) 33 Fuel taxes 37 Expenses 35

4684 (casualty and theft) 18 Income 22

4797 (sale of business G Inventories 15

property) 18, 24 Gains and losses 23 Investment credit 19

4868 (extension) 8 General business credits 18

6251 (alternative minimum tax) 18

Publication 334 (2022) Page 51