Page 59 - Small Business Taxes

P. 59

16:29 - 11-Jan-2023

Page 53 of 53

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

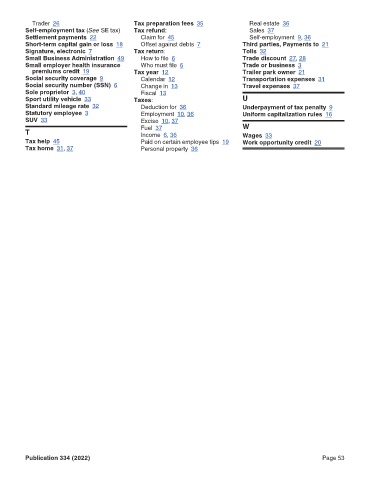

Trader 26 Fileid: … tions/p334/2022/a/xml/cycle03/source Real estate 36

Tax preparation fees 35

Self-employment tax (See SE tax) Tax refund: Sales 37

Settlement payments 22 Claim for 45 Self-employment 9, 36

Short-term capital gain or loss 18 Offset against debts 7 Third parties, Payments to 21

Signature, electronic 7 Tax return: Tolls 32

Small Business Administration 49 How to file 6 Trade discount 27, 28

Small employer health insurance Who must file 6 Trade or business 3

premiums credit 19 Tax year 12 Trailer park owner 21

Social security coverage 9 Calendar 12 Transportation expenses 31

Social security number (SSN) 6 Change in 13 Travel expenses 37

Sole proprietor 3, 40 Fiscal 13

Sport utility vehicle 33 Taxes: U

Standard mileage rate 32 Deduction for 36 Underpayment of tax penalty 9

Statutory employee 3 Employment 10, 36 Uniform capitalization rules 16

SUV 33 Excise 10, 37

T Fuel 37 W

Income 6, 36

Wages 33

Tax help 45 Paid on certain employee tips 19 Work opportunity credit 20

Tax home 31, 37 Personal property 36

Publication 334 (2022) Page 53