Page 216 - Internal Auditing Standards

P. 216

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

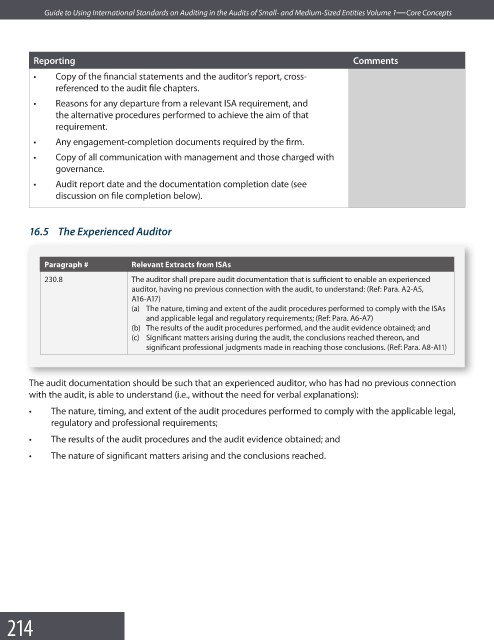

Reporting Comments

• Copy of the financial statements and the auditor’s report, cross-

referenced to the audit fi le chapters.

• Reasons for any departure from a relevant ISA requirement, and

the alternative procedures performed to achieve the aim of that

requirement.

• Any engagement-completion documents required by the fi rm.

• Copy of all communication with management and those charged with

governance.

• Audit report date and the documentation completion date (see

discussion on file completion below).

16.5 The Experienced Auditor

Paragraph # Relevant Extracts from ISAs

230.8 The auditor shall prepare audit documentation that is sufficient to enable an experienced

auditor, having no previous connection with the audit, to understand: (Ref: Para. A2-A5,

A16-A17)

(a) The nature, timing and extent of the audit procedures performed to comply with the ISAs

and applicable legal and regulatory requirements; (Ref: Para. A6-A7)

(b) The results of the audit procedures performed, and the audit evidence obtained; and

(c) Significant matters arising during the audit, the conclusions reached thereon, and

significant professional judgments made in reaching those conclusions. (Ref: Para. A8-A11)

The audit documentation should be such that an experienced auditor, who has had no previous connection

with the audit, is able to understand (i.e., without the need for verbal explanations):

• The nature, timing, and extent of the audit procedures performed to comply with the applicable legal,

regulatory and professional requirements;

• The results of the audit procedures and the audit evidence obtained; and

• The nature of significant matters arising and the conclusions reached.

214