Page 214 - Internal Auditing Standards

P. 214

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

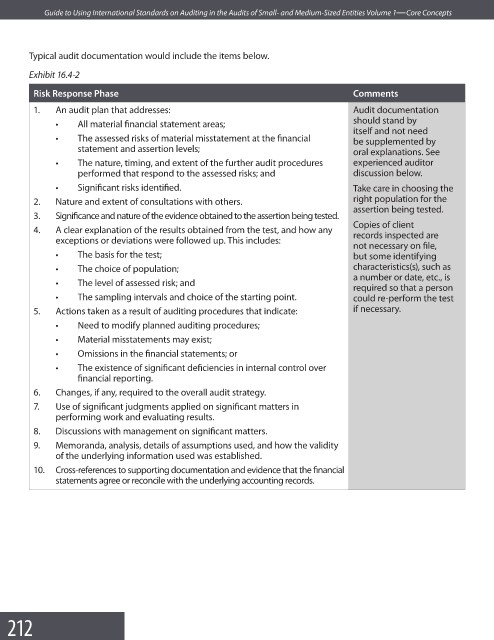

Typical audit documentation would include the items below.

Exhibit 16.4-2

Risk Response Phase Comments

1. An audit plan that addresses: Audit documentation

should stand by

• All material financial statement areas;

itself and not need

• The assessed risks of material misstatement at the fi nancial be supplemented by

statement and assertion levels; oral explanations. See

• The nature, timing, and extent of the further audit procedures experienced auditor

performed that respond to the assessed risks; and discussion below.

• Significant risks identifi ed. Take care in choosing the

2. Nature and extent of consultations with others. right population for the

assertion being tested.

3. Significance and nature of the evidence obtained to the assertion being tested.

Copies of client

4. A clear explanation of the results obtained from the test, and how any records inspected are

exceptions or deviations were followed up. This includes:

not necessary on fi le,

• The basis for the test; but some identifying

• The choice of population; characteristics(s), such as

a number or date, etc., is

• The level of assessed risk; and

required so that a person

• The sampling intervals and choice of the starting point. could re-perform the test

5. Actions taken as a result of auditing procedures that indicate: if necessary.

• Need to modify planned auditing procedures;

• Material misstatements may exist;

• Omissions in the financial statements; or

• The existence of signifi cant deficiencies in internal control over

fi nancial reporting.

6. Changes, if any, required to the overall audit strategy.

7. Use of significant judgments applied on significant matters in

performing work and evaluating results.

8. Discussions with management on signifi cant matters.

9. Memoranda, analysis, details of assumptions used, and how the validity

of the underlying information used was established.

10. Cross-references to supporting documentation and evidence that the fi nancial

statements agree or reconcile with the underlying accounting records.

212