Page 210 - Internal Auditing Standards

P. 210

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

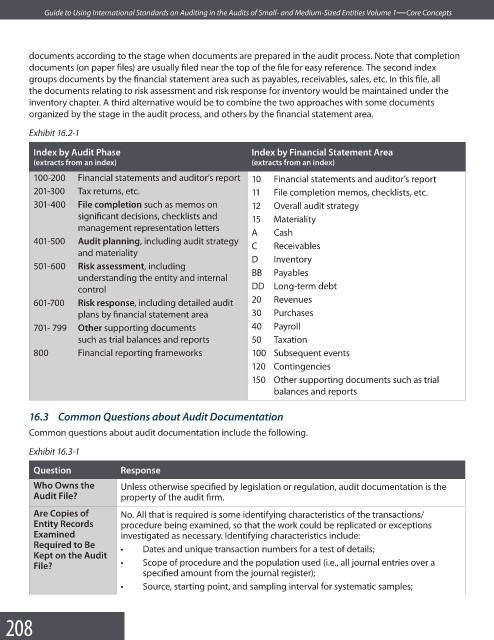

documents according to the stage when documents are prepared in the audit process. Note that completion

documents (on paper files) are usually filed near the top of the file for easy reference. The second index

groups documents by the financial statement area such as payables, receivables, sales, etc. In this fi le, all

the documents relating to risk assessment and risk response for inventory would be maintained under the

inventory chapter. A third alternative would be to combine the two approaches with some documents

organized by the stage in the audit process, and others by the financial statement area.

Exhibit 16.2-1

Index by Audit Phase Index by Financial Statement Area

(extracts from an index) (extracts from an index)

100-200 Financial statements and auditor’s report 10 Financial statements and auditor’s report

201-300 Tax returns, etc. 11 File completion memos, checklists, etc.

301-400 File completion such as memos on 12 Overall audit strategy

significant decisions, checklists and 15 Materiality

management representation letters

A Cash

401-500 Audit planning, including audit strategy

C Receivables

and materiality

D Inventory

501-600 Risk assessment, including

BB Payables

understanding the entity and internal

DD Long-term debt

control

601-700 Risk response, including detailed audit 20 Revenues

plans by financial statement area 30 Purchases

701- 799 Other supporting documents 40 Payroll

such as trial balances and reports 50 Taxation

800 Financial reporting frameworks 100 Subsequent events

120 Contingencies

150 Other supporting documents such as trial

balances and reports

16.3 Common Questions about Audit Documentation

Common questions about audit documentation include the following.

Exhibit 16.3-1

Question Response

Who Owns the Unless otherwise specified by legislation or regulation, audit documentation is the

Audit File? property of the audit fi rm.

Are Copies of No. All that is required is some identifying characteristics of the transactions/

Entity Records procedure being examined, so that the work could be replicated or exceptions

Examined investigated as necessary. Identifying characteristics include:

Required to Be • Dates and unique transaction numbers for a test of details;

Kept on the Audit

File? • Scope of procedure and the population used (i.e., all journal entries over a

specified amount from the journal register);

• Source, starting point, and sampling interval for systematic samples;

208