Page 215 - Internal Auditing Standards

P. 215

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

r

t

o

p

ing

Re

Reporting

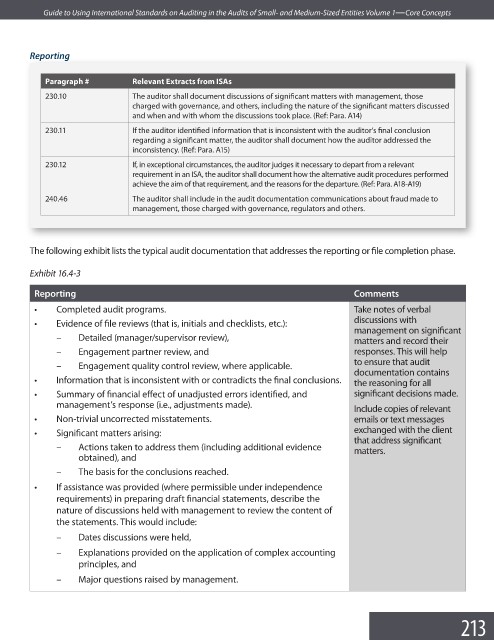

Paragraph # Relevant Extracts from ISAs

230.10 The auditor shall document discussions of significant matters with management, those

charged with governance, and others, including the nature of the significant matters discussed

and when and with whom the discussions took place. (Ref: Para. A14)

230.11 If the auditor identified information that is inconsistent with the auditor’s fi nal conclusion

regarding a significant matter, the auditor shall document how the auditor addressed the

inconsistency. (Ref: Para. A15)

230.12 If, in exceptional circumstances, the auditor judges it necessary to depart from a relevant

requirement in an ISA, the auditor shall document how the alternative audit procedures performed

achieve the aim of that requirement, and the reasons for the departure. (Ref: Para. A18-A19)

240.46 The auditor shall include in the audit documentation communications about fraud made to

management, those charged with governance, regulators and others.

The following exhibit lists the typical audit documentation that addresses the reporting or file completion phase.

Exhibit 16.4-3

Reporting Comments

• Completed audit programs. Take notes of verbal

discussions with

• Evidence of file reviews (that is, initials and checklists, etc.):

management on signifi cant

– Detailed (manager/supervisor review), matters and record their

– Engagement partner review, and responses. This will help

to ensure that audit

– Engagement quality control review, where applicable.

documentation contains

• Information that is inconsistent with or contradicts the fi nal conclusions. the reasoning for all

• Summary of fi nancial effect of unadjusted errors identifi ed, and significant decisions made.

management’s response (i.e., adjustments made).

Include copies of relevant

• Non-trivial uncorrected misstatements. emails or text messages

• Significant matters arising: exchanged with the client

that address signifi cant

– Actions taken to address them (including additional evidence matters.

obtained), and

– The basis for the conclusions reached.

• If assistance was provided (where permissible under independence

requirements) in preparing draft financial statements, describe the

nature of discussions held with management to review the content of

the statements. This would include:

– Dates discussions were held,

– Explanations provided on the application of complex accounting

principles, and

– Major questions raised by management.

213