Page 426 - TaxAdviser_2022

P. 426

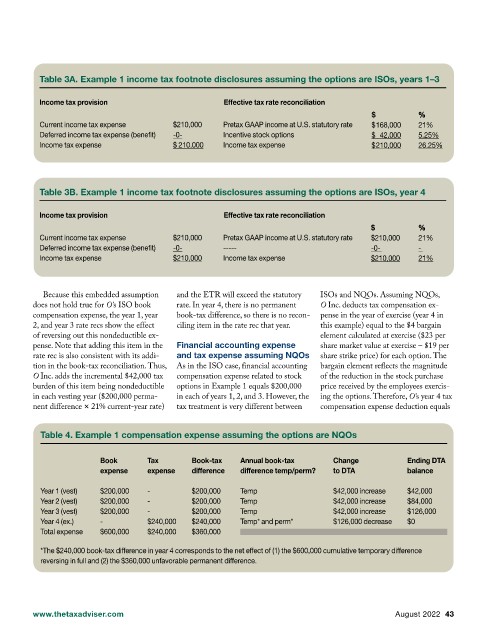

Table 3A. Example 1 income tax footnote disclosures assuming the options are ISOs, years 1–3

Income tax provision Effective tax rate reconciliation

$ % %

Current income tax expense $210,000 Pretax GAAP income at U.S. statutory rate $ 168,000 21%

Deferred income tax expense (benefit) -0- Incentive stock options $ 42,000 5.25%

Income tax expense $ 210,000 Income tax expense $ 210,000 26.25%

Table 3B. Example 1 income tax footnote disclosures assuming the options are ISOs, year 4

Income tax provision Effective tax rate reconciliation

$ % %

Current income tax expense $210,000 Pretax GAAP income at U.S. statutory rate $210,000 21%

Deferred income tax expense (benefit) -0- ----- -0- -

Income tax expense $210,000 Income tax expense $210,000 21%

Because this embedded assumption and the ETR will exceed the statutory ISOs and NQOs. Assuming NQOs,

does not hold true for O’s ISO book rate. In year 4, there is no permanent O Inc. deducts tax compensation ex-

compensation expense, the year 1, year book-tax difference, so there is no recon- pense in the year of exercise (year 4 in

2, and year 3 rate recs show the effect ciling item in the rate rec that year. this example) equal to the $4 bargain

of reversing out this nondeductible ex- element calculated at exercise ($23 per

pense. Note that adding this item in the Financial accounting expense share market value at exercise – $19 per

rate rec is also consistent with its addi- and tax expense assuming NQOs share strike price) for each option. The

tion in the book-tax reconciliation. Thus, As in the ISO case, financial accounting bargain element reflects the magnitude

O Inc. adds the incremental $42,000 tax compensation expense related to stock of the reduction in the stock purchase

burden of this item being nondeductible options in Example 1 equals $200,000 price received by the employees exercis-

in each vesting year ($200,000 perma- in each of years 1, 2, and 3. However, the ing the options. Therefore, O’s year 4 tax

nent difference × 21% current-year rate) tax treatment is very different between compensation expense deduction equals

Table 4. Example 1 compensation expense assuming the options are NQOs

Book Tax Book-tax Annual book-tax Change Ending DTA

expense expense difference difference temp/perm? to DTA balance

Year 1 (vest) $200,000 - $200,000 Temp $42,000 increase $42,000

Year 2 (vest) $200,000 - $200,000 Temp $42,000 increase $84,000

Year 3 (vest) $200,000 - $200,000 Temp $42,000 increase $126,000

Year 4 (ex.) - $240,000 $240,000 Temp* and perm* $126,000 decrease $0

Total expense $600,000 $240,000 $360,000

*The $240,000 book-tax difference in year 4 corresponds to the net effect of (1) the $600,000 cumulative temporary difference

reversing in full and (2) the $360,000 unfavorable permanent difference.

www.thetaxadviser.com August 2022 43