Page 430 - TaxAdviser_2022

P. 430

apply, in that the temporary difference

Because NQOs over vesting will create a DTA that will For financial

be fully reversed when an expense is

generate a future recognized for tax purposes. The per- reporting purposes,

tax deduction, the manent component will be a reconciling ASC Paragraph

item in the rate rec in the year of the tax

issuing company will expense. The SEC Form 10-K reader 718-10-35-2

originate a temporary will be able to find more detail regard- requires companies

book-tax difference at ing what a company has included in a to expense

“stock-based compensation” reconciling

issuance. item by searching the stock compensa- the fair value

tion footnote.

of the stock options

Bridging the classroom to granted over the

an NQO being exercised (which could professional practice requisite service

be an addition or subtraction depending To further reinforce the importance of

on the magnitude of the bargain ele- detailed Topic 740 knowledge, instruc- period.

ment at exercise relative to the fair-value tors should strongly consider inviting a

estimate at grant), or the effect of other Topic 740 practitioner to class to discuss

types of stock-based compensation its various provisions. While the subject-

such as restricted stock or restricted matter expert could discuss accounting company’s ETR. (Also relevant in that

stock units. It could also be a combina- for income taxes in broad terms, that policy discussion is the change to the

tion thereof. person’s expertise would be best used by types of compensation included in the

Similar to NQOs, restricted stock covering a more nuanced topic within $1 million deduction limit for covered

and restricted stock units under Topic the field, such as stock-based compensa- employees, which the 2017 law known

718 are valued at grant for financial tion income tax effects. as the Tax Cuts and Jobs Act, P.L.

purposes and expensed over the vesting This column can also be used to add 115-97, expanded to include the exercise

period on the income statement. Both valuable insight into classroom policy of newly issued NQOs and other types

later yield a deduction for the company, discussions surrounding NQOs, namely of performance-based pay.) Further,

but the computation and timing for the the significantly larger tax deduction firms can use this column to comple-

tax deduction is different than NQOs these options can generate relative to the ment their own training materials for

and is beyond the scope of this column. fair-value estimate expensed for financial new hires, or for those transitioning into

However, the same general principles purposes and the related decrease in the the Topic 740 practice area. ■

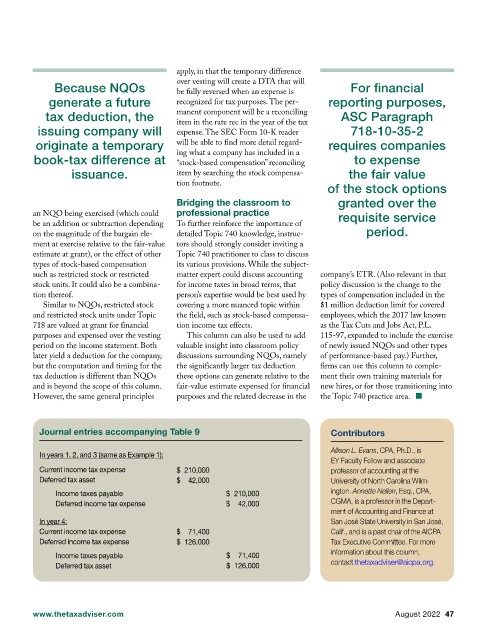

Journal entries accompanying Table 9 Contributors

Allison L. Evans, CPA, Ph.D., is

In years 1, 2, and 3 (same as Example 1):

EY Faculty Fellow and associate

Current income tax expense $ 210,000 professor of accounting at the

Deferred tax asset $ 42,000 University of North Carolina Wilm-

Income taxes payable $ 210,000 ington. Annette Nellen, Esq., CPA,

Deferred income tax expense $ 42,000 CGMA, is a professor in the Depart-

ment of Accounting and Finance at

In year 4: San José State University in San José,

Current income tax expense $ 71,400 Calif., and is a past chair of the AICPA

Deferred income tax expense $ 126,000 Tax Executive Committee. For more

information about this column,

Income taxes payable $ 71,400

Deferred tax asset $ 126,000 contact thetaxadviser@aicpa.org.

www.thetaxadviser.com August 2022 47