Page 428 - TaxAdviser_2022

P. 428

component of the NQO at exercise. years 1, 2, and 3 identically to Example

The year 4 NQO effect increases the 1. At exercise in year 4, the tax com-

hypothetical tax on book income in the Unlike the pensation expense deduction will equal

rate rec by $75,600 ($360,000 × 21% nondeductibility $660,000 ([$30 per share market price

current-year rate) because O Inc. deducts of ISOs, Sec. – $19 per share strike price] × 60,000

$360,000 less in total for tax purposes shares purchased at exercise), reflecting

than it expenses for financial purposes 83(a) and Regs. the larger bargain element enjoyed by

(which is the same reason the permanent Sec. 1.83-7(a) allow the employee in this example ($11 per

difference is an addition in the book-tax share in Example 2, versus $4 per share

reconciliation). companies a tax in Example 1). Table 7 on p. 46 reports

deduction when the expense numbers and Topic 740 ef-

Example 2: Example 2 keeps the an employee fects for Example 2.

same assumptions as Example 1 with At exercise, O Inc. finally knows it

exercises an NQO.

one exception. Instead of assum- will expense an additional $60,000 for

ing the stock’s market price on the tax purposes beyond what it previously

exercise date is $23 per share, now recognized for financial purposes over

assume that it is $30 per share. never a deduction for ISOs for tax pur- the vesting period. Therefore, year 4’s

poses. Therefore, Tables 1, 2, 3A, and 3B $660,000 book-tax difference must

Financial accounting expense are correct for this fact pattern, as well. include both the $600,000 reversal of

and tax expense assuming ISOs the cumulative temporary difference

If the options are ISOs, the result is Financial accounting expense (as discussed with Example 1) as well

the same in all ways between this fact and tax expense assuming NQOs as the $60,000 permanent difference.

pattern and Example 1. Financial ac- If one assumes the options are NQOs, Unlike Example 1, in this example the

counting does not use exercise-date the effect in the three vesting years is the permanent difference is a favorable

information as an input, so book com- same as in Example 1 because the iden- one because O Inc. deducts more, in

pensation expense still totals $600,000 tical book expense is recognized in those total over time, for tax than for book.

spread evenly over the vesting years years and O Inc. will not recognize tax As such, the permanent component

($200,000 of the expense in each of expense until NQO exercise. Therefore, is a subtraction in the book-tax

years 1, 2, and 3). And again, there is the DTA account will be originated in reconciliation shown in the final column

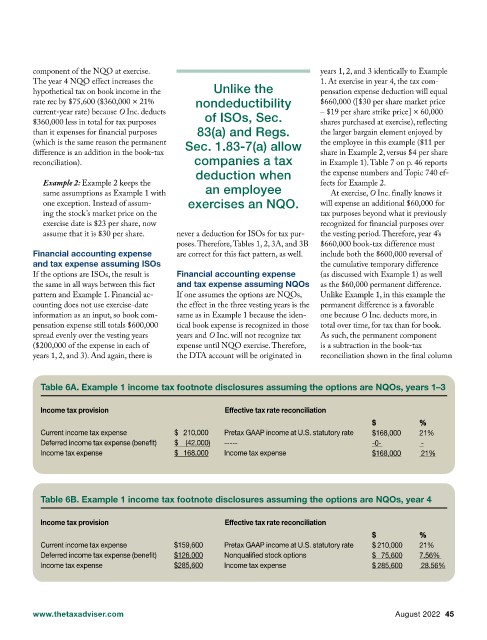

Table 6A. Example 1 income tax footnote disclosures assuming the options are NQOs, years 1–3

Income tax provision Effective tax rate reconciliation

$ % %

Current income tax expense $ 210,000 Pretax GAAP income at U.S. statutory rate $168,000 21%

Deferred income tax expense (benefit) $ (42,000) ----- -0- -

Income tax expense $ 168,000 Income tax expense $168,000 21%

Table 6B. Example 1 income tax footnote disclosures assuming the options are NQOs, year 4

Income tax provision Effective tax rate reconciliation

$ % %

Current income tax expense $159,600 Pretax GAAP income at U.S. statutory rate $ 210,000 21%

Deferred income tax expense (benefit) $126,000 Nonqualified stock options $ 75,600 7.56%

Income tax expense $285,600 Income tax expense $ 285,600 28.56%

www.thetaxadviser.com August 2022 45